The Current Stock Market Landscape

The S&P 500 and the Nasdaq finished Thursday trading flat, making up ground following earlier losses. Despite slightly hotter-than-projected headline inflation data, Wall Street took comfort in the fact that Core monthly CPI matched projections and Core YoY came in slightly lower than the prior month.

Wall Street is looking beyond any lingering inflation worries to earnings season. The S&P 500 traded just below its all-time highs as JPMorgan and others kick off the busy stretch of Q4 earnings.

Fastenal – A Solid Bet in Industrial Supplies

Fastenal is a wholesale distributor of industrial supplies, construction tools, safety products, and beyond, ranging from fasteners and electrical supplies to hardware, building supplies, and much more. The company offers various distribution and delivery methods, including industrial-style vending machines and other unique offerings from roughly 3,400 in-market locations that include local hubs, customer-specific onsite areas, and more.

Fastenal is less vulnerable to the boom-and-bust cycles of the broader industrial and construction segments because it doesn’t sell big-ticket items. Fastenal’s smaller components are key cogs to countless companies and industries at all times. The company has grown its sales every year since the financial crisis, including 16% sales expansion last year.

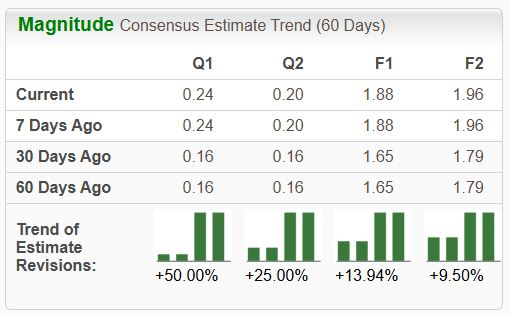

Fastenal is projected to post 5% revenue growth in 2023 and 6% higher sales next year to boost its adjusted earnings by 6% both periods. Fastenal’s positive EPS revisions help it land a Zacks Rank #2 (Buy) right now. The company also boasts an impressive balance sheet that has allowed it to boost its dividend by significant margins recently.

Stride, Inc. – An Education Firm on the Rise

Stride is a top digital education firm with offerings that reach students of all ages in the U.S. and globally. The company’s various services serve K–12 students and parents, as well as adult learners, school districts, businesses, the military, and beyond.

Stride’s revenue climbed 9% in its fiscal 2023 and 10% in FY22, after it soared 48% during FY21 (boosted by Covid). The firm’s positive quarterly results and upbeat guidance are backed by its strength in the career learning segment, especially from its middle and high school cohort.

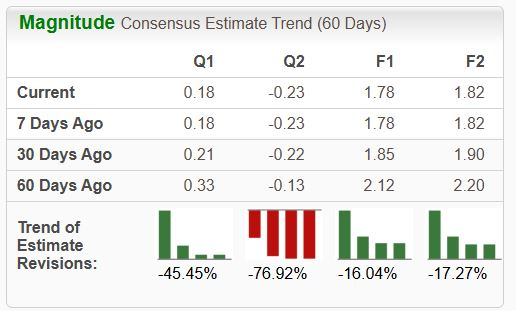

Zacks estimates call for Stride’s revenue to climb another 9% this year and over 6% higher next year, while its adjusted earnings are projected to soar by 35% and 13%, respectively. Stride shares have climbed 155% in the last three years to outperform the S&P 500’s performance. The company’s stock has significant room to grow, trading far below its historical highs and at a compelling discount to its 10-year median valuation.

Netflix (

Netflix’s Battle for Streaming Supremacy

Netflix (NFLX) changed the entertainment industry forever, transforming how people consume movies and TV shows. NFLX’s pioneering position and expanding content library have solidified its dominance over rivals such as Disney (DIS), Apple, and Amazon. Nevertheless, the stock faced severe setbacks due to stagnant user growth, rising competition, and industry consolidation concerns.

The Rise and Fall of NFLX

Over the past decade, Netflix has surmounted numerous anxieties, consistently surpassing earnings projections for Q1, Q2, and Q3. Furthermore, it registered a remarkable 8% increase in paid memberships in Q2 and an 11% surge in the third quarter, boasting over 247 million subscribers—outstripping Disney+’s tally of 150 million.

Netflix’s budget-friendly ad-based tier has gained significant traction, coupled with recent substantial user growth announcements. The company is also intensifying efforts to curb excessive account sharing. Moreover, NFLX is projected to boost its revenue by over 6% in 2023 and 14% in FY24, underpinning an impressive 22% and 32% surge in adjusted earnings, respectively. NFLX’s buoyant EPS revisions and optimistic activity support its current Zacks Rank #2 (Buy) status.

Stock Resilience and Valuation

Despite a nearly 200% ascent from its troughs, Netflix’s stock still lingers 30% below its peaks. Furthermore, over the past decade, the stock has skyrocketed by 933%, eclipsing the tech sector’s 250% growth. NFLX is also trading above crucial short-term and long-term moving averages. From a valuation perspective, Netflix is presently trading at a 60% discount to its 10-year median and 95% below its peak, with a forward 12-month earnings multiple of 29.8X.

The New Gold Rush: How Lithium Batteries Will Make Millionaires

As the electric vehicle revolution expands, investors have a chance to target huge gains. Millions of lithium batteries are being made & demand is expected to increase 889%.

Download the brand-new FREE report revealing 5 EV battery stocks set to soar.

Netflix, Inc. (NFLX) : Free Stock Analysis Report.

Fastenal Company (FAST) : Free Stock Analysis Report.

The Walt Disney Company (DIS) : Free Stock Analysis Report.

Stride, Inc. (LRN) : Free Stock Analysis Report.

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.