The Green Giant: Ecolab’s Soaring Success

Amidst the financial tumult of recent months, the steadfast rise of Ecolab (ECL) stock shines as a beacon of hope. This sustainability firm has surged an impressive 35% in the last half-year, outpacing the S&P 500 by a commanding margin and enjoying a robust 15% year-to-date climb.

The Bull Case for Ecolab

Ecolab stands as a stalwart of the sustainability movement, dedicated to enhancing food safety, promoting cleanliness, and optimizing energy and water usage. Its influence spans over 170 countries, catering to a diverse array of markets including food, healthcare, life sciences, and industrial sectors.

Image Source: Zacks Investment Research

Not content with merely maintaining status quo, Ecolab’s innovative cleaning, sanitizing, and pest control solutions have revolutionized operations across various industries. Their products play a vital role in water treatment, pollution control, energy conservation, and several industrial processes – a testament to their adaptability and efficacy.

Image Source: Zacks Investment Research

An Unstoppable Force: Ecolab’s Financial Fortitude

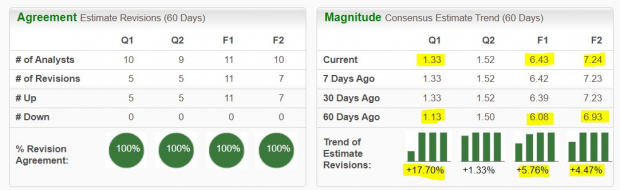

Forecasts predict robust growth for Ecolab, with anticipated sales upticks in FY24 and FY25, expected to culminate in nearly $17 billion in revenue. Bolstered by these promising projections, Ecolab’s adjusted earnings per share are set to rise by 23% and 13%, respectively. Such figures are not merely speculative; they underscore a track record of financial ascendancy that has propelled Ecolab to the elite ranks of the S&P 500 dividend aristocrats.

Image Source: Zacks Investment Research

Finding the Silver Lining

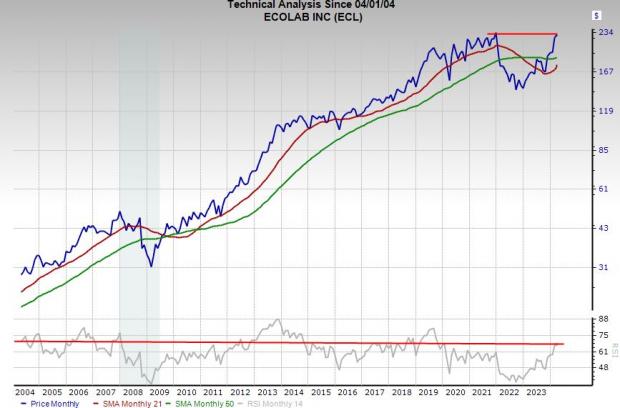

Ecolab’s journey is one marked by resilience and growth, significantly outstripping the broader market over the past two decades. Despite its impressive ascent, this sustainability powerhouse is trading at a modest discount to its historical highs, presenting a potential opportunity for investors seeking long-term value amidst a landscape of uncertainty.

While caution may be warranted due to recent market exuberance, Ecolab’s solid positioning near key support levels suggests that an upward trajectory could be on the horizon. With its eyes set on surpassing previous milestones and scaling new peaks, Ecolab stands as a steadfast contender in the realm of sustainable investing.

The Verdict: Ecolab’s Enduring Allure

For those seeking a robust addition to their investment portfolio, Ecolab presents a compelling case as a long-term, dividend-yielding cornerstone. As one of the select few S&P 500 dividend aristocrats, Ecolab’s proven track record of consistent performance and shareholder value appreciation makes it a beacon of stability in an ever-changing financial landscape.

Ladies and gentlemen, in the ever-evolving saga of financial markets, Ecolab’s ascent stands as a testament to the enduring power of sustainability, innovation, and prudent investment decisions. As we navigate the turbulent waters of economic uncertainty, Ecolab emerges as a beacon of hope, offering investors a solid foundation on which to build their financial future.

Zacks Names “Single Best Pick to Double”: Uncover the hidden gem poised for exponential growth as experts pinpoint this under-the-radar, high-potential stock. With remarkable earnings estimates and ample resources for share repurchasing, it’s a prime opportunity for savvy investors seeking substantial returns.

This overlooked chemical company, dubbed the “dark horse” of markets, is primed for a meteoric rise, rivaling recent success stories like Boston Beer Company and NVIDIA. Positioned as the frontrunner among Zacks’ top stock picks, it stands as a testament to the untapped potential within the financial markets.

Free: Discover Our Top Stock Pick and 4 Runners Up >>

Ecolab Inc. (ECL) : Access Free Stock Analysis Report

Read the original article on Zacks.com

For more insights, visit Zacks Investment Research

Kindly note that the views expressed here are the author’s own and may differ from those of Nasdaq, Inc.