Stock buybacks, or share repurchase programs, are commonly executed by companies to boost shareholder value.

A stock buyback occurs when a company purchases outstanding shares of its stock. In its simplest form, buybacks represent companies essentially re-investing in themselves.

In 2024, several companies – Apple AAPL, Marathon Petroleum MPC, and AutoNation AN – have unveiled repurchase programs. Let’s take a closer look at each.

Apple

Apple recently reported quarterly results, bringing post-earnings fireworks. Concerning headline figures, the company posted a 1.3% beat relative to the Zacks Consensus EPS estimate and posted sales 1% ahead of expectations.

To the surprise of many, the tech titan announced the biggest buyback in corporate history totaling $110 billion. Reflecting further positivity, Apple also unveiled a 4% boost to its quarterly payout, reflecting the 12th consecutive year of higher payouts.

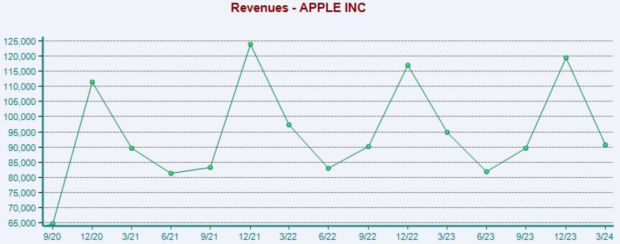

Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

Marathon Petroleum

MPC is also coming off a recent double beat, with the company posting a 10% surprise relative to the Zacks Consensus EPS estimate and reporting sales 6% ahead of the consensus. The company unveiled an additional $5 billion share buyback program.

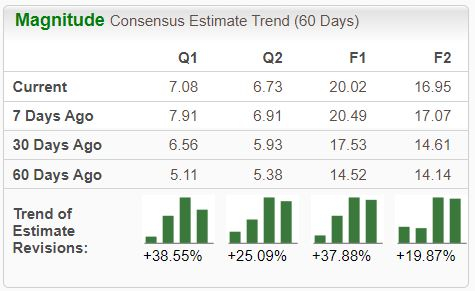

The company’s earnings outlook overall remains positive across the board, with some adjustments hitting the tape post-earnings.

Image Source: Zacks Investment Research

AutoNation

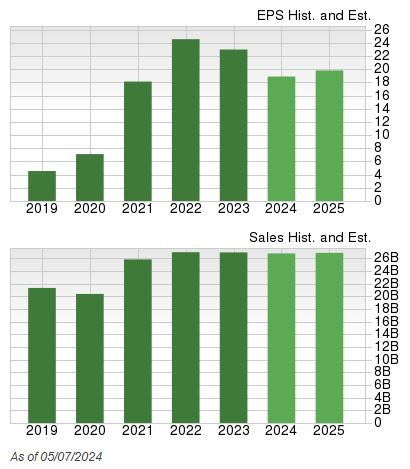

AutoNation shares have marginally outperformed the S&P 500 year-to-date, with its recent set of quarterly results boosting performance. The company recently unveiled an additional $1 billion share buyback program.

The company’s growth is forecasted to cool in its current fiscal year, with the $18.78 Zacks Consensus EPS estimate suggesting an 18% year-over-year decline on -0.2% lower sales. Growth is expected to resume modestly in FY25, as consensus expectations suggest a 5% recovery on 0.8% improved sales.

Image Source: Zacks Investment Research

Bottom Line

A common way that companies amplify shareholder value is through implementing share buybacks. They can provide a nice confidence boost for investors, indicating that the company is utilizing excess cash and can help put in a floor for shares.

And recently, all companies above – Apple AAPL, Marathon Petroleum MPC, and AutoNation AN – unveiled additional or fresh buyback programs.

Where Will Stocks Go…

If Biden Wins? If Trump Wins?

The answers may surprise you.

Since 1950, even after negative midterm years, the market has never had a lower presidential election year. With voters energized and engaged, the market has been almost unrelentingly bullish no matter which party wins!

Now is the time to download Zacks’ free Special Report with 5 stocks that offer extreme upside for both Democrats and Republicans…

1. Medical manufacturer has gained +11,000% in the last 15 years.

2. Rental company is absolutely crushing its sector.

3. Energy powerhouse plans to grow its already large dividend by 25%.

4. Aerospace and defense standout just landed a potentially $80 billion contract.

5. Giant Chipmaker is building huge plants in the U.S.

Hurry, Download Special Report FREE >>

Apple Inc. (AAPL) : Free Stock Analysis Report

AutoNation, Inc. (AN) : Free Stock Analysis Report

Marathon Petroleum Corporation (MPC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.