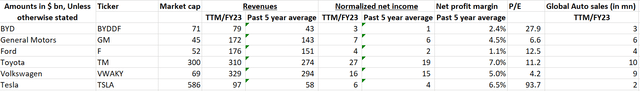

BYD Company (OTCPK:BYDDF), a major player in the Chinese electric vehicle (“EV”) manufacturing realm, has garnered substantial attention from analysts due to its sales growth and profitability. With a market cap of $71 billion, the company’s valuation commands scrutiny when compared to its industry peers.

An Industry Compared

Presenting a comparative financial analysis of major automakers is essential to discern BYD’s positioning. Notably, while there are varied metrics for valuation, I delve into P/E ratios and revenue figures to draw meaningful comparisons.

- I am using P/E as a benchmark due to inconsistencies in calculating Enterprise Value/EBITDA across companies, primarily arising from the varying classification of net debt. However, I believe the 5-year average normalized net income provides comparable insights.

- The revenue/normalized net income for the trailing twelve months (TTM) and the past 5-year average are outlined to assess the auto sales volume.

Evaluating the data reveals compelling insights:

- BYD is not undervalued, boasting the highest market cap in comparison to GM/F/VW, even when considering enterprise value. Toyota stands distinct with substantial sales volume and significantly higher profitability. Tesla, with its unique market cap, is viewed separately, while my focus centers on BYD’s comparison with traditional automakers.

- Profit margins in the automotive industry are generally modest, with Toyota and Volkswagen averaging 7% and 5% net profit margins, respectively, in the past five years. Despite notable sales volumes, TSLA attained only a 6.5% net profit margin in FY23. Thus, even if BYD enjoys a first-mover advantage in cost efficiencies, it is improbable for the company to surpass the industry’s best performers in terms of margins.

Forecasting the Future

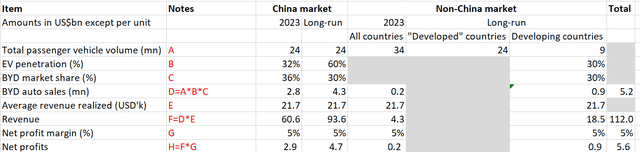

Offering my forecast for BYD’s future financials, I aim to initiate a thought experiment to elucidate the pivotal drivers. Readers are encouraged to make their adjustments to the figures based on personal assumptions. The data reveals engaging insights about the company’s trajectory and potential hurdles.

It’s essential to note that my assumptions lean towards minimal long-term value for BYD’s other business segments such as handset components and EV batteries for external sales. While certain analysts attribute significant value to BYD’s battery business, I maintain a cautious stance considering the anticipated exponential growth in global EV battery capacity juxtaposed with recent lackluster EV sales.

Further delving into the calculations and explicating my assumptions:

A: The total passenger vehicle sales by country are derived from OICA for FY22, with FY23 statistics closely resembling the former.

B: EV penetration is assumed to be 60% in China, aligned with China’s national goal for EV penetration by 2030. Correspondingly, the Rest of the World (“RoW”) exhibits a 30% assumed penetration, based on a recent survey indicating a parallel projection for Western Europe and the US by 2030. My estimations, while subject to variance, reflect the increasingly cautious stance adopted by most companies and analysts over the past year.

C:

- The market share is presumed to be 30% in China, akin to BYD’s estimated current market share. In contrast, the market share in the Rest of the World (RoW) is extrapolated from Toyota’s market share in ASEAN countries, with the assumption that BYD can achieve a similar market share in developing nations (relying on HSBC’s recent research report on BYD, titled “Which Road Does BYD Take From Here,” dated February 6, 2024).

D: Sales are a product of A*B*C. Many analysts stress BYD’s historical growth record; however, I diverge from using past growth as a reliable indicator of future growth.

- China’s EV penetration is around 35-40%, leaving limited room for further expansion, with current growth rates already exhibiting a tapering trend for BYD. With future growth rates anticipated to dwindle significantly, BYD’s journey is projected to face substantial challenges.

Furthermore, BYD’s access to developed markets is poised to remain constrained. The company’s commendable effort to establish production centers globally notwithstanding, it is increasingly improbable for the US and EU to emerge as major export destinations for BYD. Prevailing trade barriers and the strategic imperative of industrial nations to safeguard their auto industries from external competition portend a challenging future for BYD, especially in developed countries.

Operating on a conservative outlook, I have categorized USMCA/EU/Australia/New Zealand/Japan/South Korea/India as “developed” markets, while the rest of the nations constitute a market with 9 million annual sales. Additionally, I assume BYD lacks significant presence in the “developed” markets, cognizant of the complexities involved in operating within these regions and the associated intricacies.

The Uphill Battle for BYD’s Global Expansion

BYD’s Future Projections

BYD’s potential net profits are estimated to reach $5.6 billion if the company achieves 5.2 million in auto sales, with 4.3 million in China and 0.9 million worldwide. However, reaching $10 billion in net profits annually poses a significant challenge, requiring 9.6 million in auto sales. With global sales accounting for 5.5 million units, achieving this would place BYD on par with industry giants like VW and Toyota. An optimistic scenario suggests that even at $10 billion in net profits, BYD’s valuation might range from $70 billion to $120 billion.

Pricing Implications

The conclusion from this thought experiment is that BYD’s current stock price likely reflects much of its future growth prospects. The stock already factors in the success of its global strategy. Failure to meet these ambitious targets may lead to an inability to sustain the current stock price. Achieving annual profits of $7 billion implies that BYD would need to produce 6.6 million vehicles annually, with 4 million in China and 2.6 million in the rest of the world.

However, operating outside China will be a significant challenge, as penetrating developed markets would be crucial. Without access to these markets, profitability may be limited, making it difficult for BYD to achieve a sustainable price-to-earnings (P/E) ratio of 10 in the long run. As such, investors seeking undervalued opportunities may need to search elsewhere.

Industry outlook

BYD’s challenges in attaining significant profitability stem from the necessity to dominate the China market and establish a substantial presence in the rest of the world, including developed nations. While the company currently demonstrates favorable sales and financial momentum, it is far from being evidently undervalued at its present prices. Unless BYD’s aspirations of mirroring the success of Toyota, achieving comparable profit margins, and securing a significant share of the global market materialize, it faces a daunting task ahead.

It is crucial for investors to recognize that the success of BYD’s global expansion is contingent on numerous factors aligning perfectly. While the company remains an industry leader, considerable doubts exist regarding its current valuation. Investors should exercise caution and tread carefully, given the inherent risks associated with stocks not trading on major U.S. exchanges.