Byrna Technologies Sees 39% Decline: Is It a Buying Opportunity?

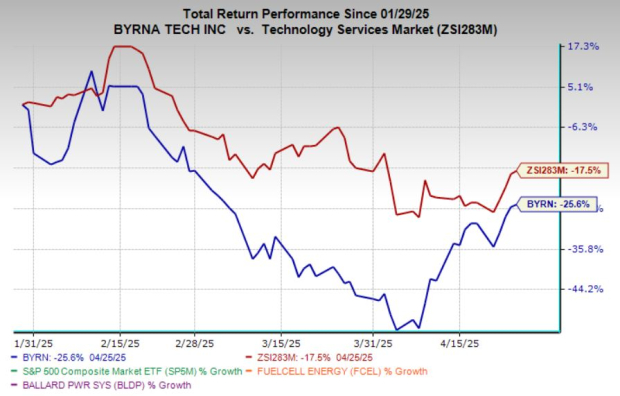

Byrna Technologies Inc. (BYRN) has experienced a significant drop in its stock price, falling 39% over the last three months, while the broader industry has only declined by 2.7%. This trend mirrors the performance of other small-cap service providers, notably FuelCell Energy (FCEL), down 52%, and Ballard Power Systems (BLDP), which fell by 24% during the same timeframe.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

As the stock faces this considerable pullback, many investors are evaluating whether Byrna’s current price presents a valuable buying opportunity.

Byrna Drives Growth Through Endorsements and Market Expansion

Byrna has significantly increased its brand visibility through an effective celebrity endorsement strategy and extensive media coverage. In fiscal 2024, the company reported more than five times its return on ad spend through these endorsements, leading to record sales of $28.0 million in the fourth quarter of fiscal 2024.

The surge in media attention has facilitated the normalization of less-lethal solutions, thereby enhancing demand from both consumers and law enforcement authorities. Byrna reported an impressive 79% year-over-year sales growth for the fourth quarter, with net income improving from a loss of $0.8 million in the previous year to a profit of $9.7 million—an increase of $10.5 million.

Looking ahead, Byrna has several strategic initiatives lined up. The company is increasing production and plans to launch its new Compact Launcher in mid-2025. In the first fiscal quarter of 2025, Byrna boosted launcher production by 33%, reaching 24,000 units per month to meet growing market demand.

In addition to increasing production, Byrna is expanding its retail presence through new company-owned stores and solidifying partnerships in Latin America with law enforcement organizations.

Recently, Byrna inked a partnership with Mexico’s Secretaría de Trabajo y Previsión Social to create a federally-certified training program that allows civilians to legally carry Byrna devices. Furthermore, the firm is enhancing its supply chain by relocating ammunition production domestically, which is expected to improve profit margins. These expansions, coupled with ongoing marketing investments, are projected to drive growth through 2025 and beyond, ensuring Byrna’s sustained success.

Strong Liquidity and Impressive Return on Equity

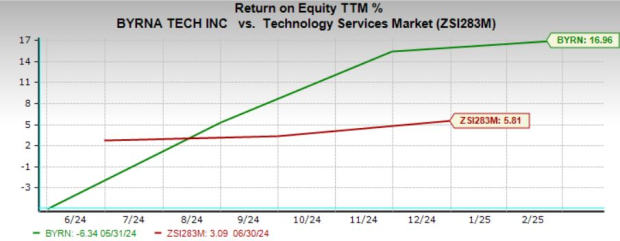

Byrna boasts a return on equity (ROE) of 15.39% at the end of the fourth quarter of fiscal 2024, well above the industry average of 5.44%. This indicates a higher level of profitability and efficient use of shareholders’ equity, suggesting effective management and superior capital utilization. A strong ROE generally correlates with higher shareholder returns, indicating potential for continued growth, which bolsters investor confidence.

Image Source: Zacks Investment Research

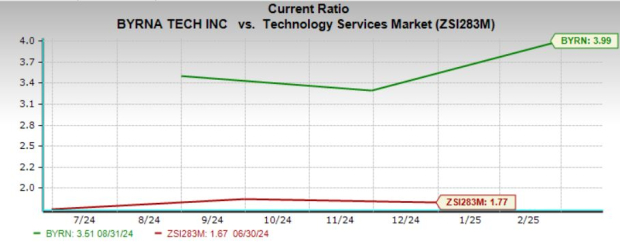

Image Source: Zacks Investment Research

In terms of liquidity, Byrna’s current ratio is an impressive 3.3 as of the end of the fourth quarter of fiscal 2024, compared to the industry’s 0.165. This strong liquidity position provides financial flexibility, allowing Byrna to invest in growth opportunities and manage unforeseen expenses without needing immediate additional financing. This stability enhances investor confidence in Byrna’s financial health and its capacity for sustainable growth and potential higher returns.

Image Source: Zacks Investment Research

Encouraging Fundamentals Ahead

Byrna is focusing on growth investments, which may pressure profitability in the short term. However, the company remains debt-free, highly profitable, and continues to show strong revenue growth along with promising market potential.

Analysts estimate Byrna’s earnings for fiscal 2025 at 31 cents, unchanged from the previous year. Earnings for 2026 are projected to rise by 58% year-over-year.

The company’s sales are anticipated to grow by 29.4% in fiscal 2025 and by 17.2% in fiscal 2026.

This optimistic outlook is supported by recent upward revisions. In the past 30 days, two estimates for fiscal 2025 earnings were revised up, with no downward revisions. The consensus estimate for fiscal 2025 earnings has seen a 10.7% increase during this timeframe. Similarly, two estimates for fiscal 2026 earnings have been adjusted upwards, with no downward changes. The consensus for fiscal 2026 earnings has increased by 29% in this period.

BYRN: A Buy Recommendation

BYRN shows promise as a growth investment, bolstered by robust brand momentum and an expanding market presence. The company’s strategic use of celebrity endorsements and broad media outreach has enhanced its visibility and ramped up demand for its innovative, less-lethal solutions. Byrna’s commitment to broadening its product range and creating local and international partnerships reveals a forward-thinking strategy aligned with market trends, placing it in a strong position for sustained growth.

Moreover, Byrna’s solid liquidity and effective resource management establish a strong foundation that supports its growth initiatives. With plans to further expand retail locations, enhance the supply chain, and launch new products, Byrna is well-equipped to meet increasing demand. For investors seeking high-growth potential and a strategic outlook, Byrna Technologies appears to be a strong Buy, underpinned by promising indicators of continued success.

BYRN currently holds a Zacks Rank of #1 (Strong Buy).