C3.ai, Inc. reported a 26% year-over-year revenue growth for its fourth-quarter fiscal 2025, driven by subscription services, closing the year with $742.7 million in cash and no debt. Despite these figures, the company recorded a non-GAAP operating loss of $31.2 million, highlighting challenges in achieving profitability. CEO Tom Siebel noted C3.ai’s unique position as a pure-play enterprise AI application provider with over 130 turnkey AI solutions deployed in various industries.

As competition intensifies with tech giants like Microsoft and Palantir Technologies, C3.ai must navigate increasing pressure in the AI market. Microsoft’s integration of AI in its Azure and Office platforms and Palantir’s robust defense and healthcare applications pose significant challenges. Both companies have extensive resources and established client networks, putting C3.ai’s future growth and innovation at stake.

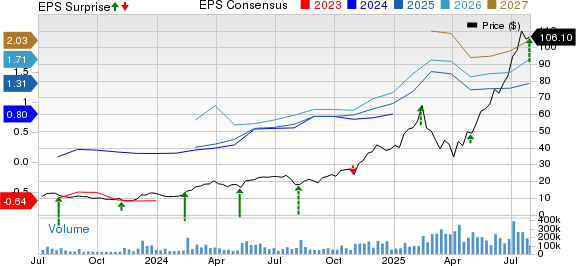

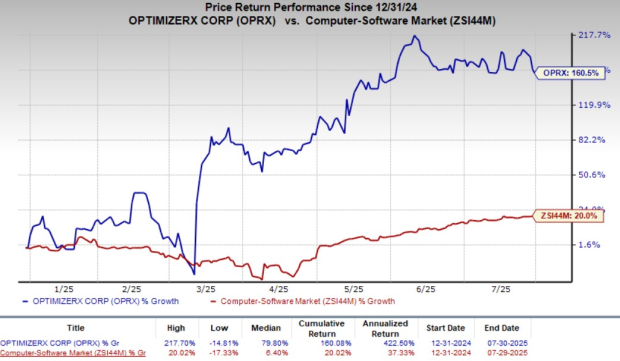

The consensus estimates for C3.ai project a revenue growth of 20.1% for fiscal 2026 and 21.8% for fiscal 2027, as the stock trades at a forward price-to-sales ratio of 6.68—indicating it is currently valued lower than its industry peers.