“`html

C3.ai reported fiscal 2025 revenues of $108.7 million, a 26% increase year-over-year. However, its preliminary first-quarter fiscal 2026 revenue is projected between $70.2-$70.4 million, down approximately 19% from $87.2 million a year earlier, leading to a significant drop in stock price by over 25% due to missed guidance. The company currently has a GAAP operating loss estimate of $124.7-$124.9 million.

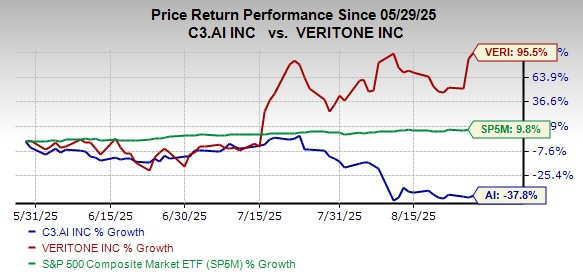

Veritone has shown encouraging growth in 2025, with a public sector pipeline expansion to $189 million and a significant contract with the U.S. Air Force. The company processed 5 trillion tokens of data and signed 35 new public sector customers. Despite cash management challenges, Veritone’s stock increased by 95.5% in the last three months, supported by a reduced loss estimate for 2025 now at 55 cents per share.

As of July 2025, C3.ai had $711.9 million in liquidity, while Veritone had only $13.6 million in cash. C3.ai’s stock is down 37.8% over three months, while Veritone has seen substantial gains amid ongoing market competition and economic uncertainties.

“`