C3.ai Faces Challenges Amid Market Volatility and Competition

C3.ai, Inc. has experienced a significant downturn this year, falling below crucial industry benchmarks and signaling potential technical difficulties ahead. Currently, C3.ai’s stock trades under its 50 and 200-day simple moving averages (SMAs), which suggests challenges in maintaining its recent performance levels.

C3.ai Price Movement vs. 50-Day & 200-Day Moving Averages

Image Source: Zacks Investment Research

C3.ai Underperforms Against Industry and Sector

Year-to-date, C3.ai’s shares have dropped by 40.8%. This decline surpasses that of the Zacks Computer & Technology sector, which fell 14.9%, and the Zacks Computers – IT Services industry, which decreased by 17%. Growing recession concerns have led businesses to potentially reduce investments, including in the field of artificial intelligence (AI). Consequently, this poses a risk for C3.ai, as its growth depends heavily on enterprise adoption of its AI solutions. Furthermore, C3.ai contends with ongoing operational losses and margin pressures, a situation exacerbated by a revenue mix dominated by pilot initiatives. Expenses connect with onboarding new partners, constructing enablement infrastructure, and supporting a larger global pipeline have temporarily hindered profitability.

At its current valuation, C3.ai’s stock reflects a 54.8% discount from its 52-week high of $45.08, while representing a 19.7% premium over its 52-week low of $17.03.

Image Source: Zacks Investment Research

With trade policy uncertainties, inflation worries, and shifts in consumer sentiment contributing to market volatility, the critical question arises: Can C3.ai maintain growth in the face of these challenges?

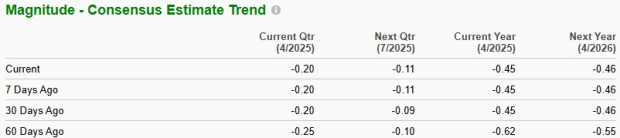

C3.ai’s Estimate Revision Trend

In the past 60 days, the Zacks Consensus Estimate for C3.ai’s fiscal 2025 and 2026 loss per share has been revised to 45 cents (down from 62 cents) and 46 cents (down from 55 cents), respectively, indicating a more optimistic outlook among analysts.

Furthermore, the Zacks Consensus Estimate for C3.ai’s revenue growth anticipates 29.7% and 22.4% increases for fiscal 2025 and 2026, respectively. (Find the latest EPS estimates and surprises on Zacks earnings Calendar.)

Image Source: Zacks Investment Research

Let’s explore the key elements that could trigger a rebound for C3.ai.

Partnerships With Tech Giants Becoming a Major Revenue Engine

Strategic partnerships are essential to C3.ai’s market strategy, and recent results validate this approach. The company’s collaboration with Microsoft Corporation (MSFT) has yielded significant outcomes. Following the announcement of an expanded alliance in late 2024, C3.ai secured 28 new deals through joint efforts across nine industries. These partnerships have noticeably shortened sales cycles by about 20%. By the end of the fiscal third quarter, C3.ai and Microsoft had over 600 active enterprise opportunities worldwide.

Additionally, C3.ai has strengthened its partnership with Amazon Web Services (AWS). This collaboration aims to deliver advanced enterprise AI solutions focused on execution speed and global scalability. The company has also recently partnered with McKinsey’s QuantumBlack division, which blends strategic consulting with C3.ai’s offerings, providing clients with strategic vision and AI execution tools.

These alliances illustrate C3.ai’s evolution into a globally distributed AI company, capable of scaling its sales and support through partner channels. Notably, 71% of agreements in the fiscal third quarter were facilitated through these partnerships.

The company’s expanding footprint is also evident in its widening customer base. C3.ai has secured new or expanded agreements with leading organizations like GSK, Sanofi, ExxonMobil, Shell, Holcim, Quest Diagnostics, and the New York Power Authority. In the federal sector, the company signed contracts with various branches, including the U.S. Navy, Air Force, and the Missile Defense Agency, along with multiple state and local governments, completing 21 deals in the quarter.

C3.ai Strengthens Lead in Generative and Agentic AI

C3.ai’s early investment in Generative and Agentic AI is paying off with real-world results. In the fiscal third quarter alone, the company launched 20 new Generative AI pilots involving clients such as Mars and various U.S. government entities. Improvements in Agentic AI, especially in data fusion and reasoning, have been enhanced by a time-series embedding model that expedites deployment for more complex applications. Transitioning from a model developer to an outcome-driven AI platform, C3.ai is capitalizing on declining inference costs across the industry with over 130 ready-to-scale applications.

Solid Top-Line Growth for C3.ai

C3.ai reported a strong third quarter for fiscal 2025, characterized by accelerated revenue growth and enhanced operational performance. Total revenues reached $98.8 million for the quarter, marking a 26% year-over-year increase. Subscription revenue, which accounted for 87% of total revenues, increased by 22% to $85.7 million. A notable contribution came from software demonstration licenses, which hit $28.6 million. These licenses, provided to partners like Microsoft and Amazon’s AWS, allow them to independently showcase C3.ai’s applications to potential enterprise clients.

A Look at C3.ai Stock Valuation

In terms of valuation, C3.ai is currently trading at a slight premium relative to its industry, but at a discount compared to historical metrics. Its forward 12-month price-to-sales (P/S) ratio is below its one-year average, currently standing at 5.71X, compared to the sector’s 5.39X.

Image Source: Zacks Investment Research

How Should Investors Approach C3.ai Stock Now?

C3.ai’s sharp downturn this year poses a complex landscape for investors. Understanding market conditions and the company’s evolving strategies will be crucial in assessing potential opportunities moving forward.

Stock Decline Creates Strategic Buying Opportunity for Investors

The recent stock decline in 2025 has opened up an attractive buying opportunity for investors. Although the company is trading below key moving averages, it continues to demonstrate strong fundamentals, including a 26% revenue growth, increasing subscription sales, and narrowing losses. Strategic partnerships with major firms, such as Microsoft, Amazon’s AWS, and McKinsey, are enhancing deal wins and expanding global reach. Additionally, the company’s leadership in Generative and Agentic AI is unlocking new high-value use cases.

Positive Growth Outlook and Analyst Sentiment

With robust growth projections and improving sentiment among analysts, the company is well-positioned for a rebound. Currently, C3.ai holds a Zacks Rank of #2 (Buy), indicating a strong buy recommendation. The combination of favorable market conditions and a discounted valuation makes this an opportune moment for investors to consider acquiring C3.ai stock.

Industry Insights: Semiconductor Market Potential

In another notable development, Zacks recently identified a top semiconductor stock that, although only 1/9,000th the size of NVIDIA, has significant growth potential. Following an impressive surge of more than 800% since our initial recommendation, NVIDIA continues to perform well. However, this new semiconductor stock presents even greater room for expansion.

This new contender boasts strong earnings growth and an expanding customer base, positioning it to capitalize on the surging demand for Artificial Intelligence, Machine Learning, and the Internet of Things. The global semiconductor manufacturing market is anticipated to grow from $452 billion in 2021 to $803 billion by 2028.

In conclusion, investors looking for promising opportunities in the current market may find significant value in exploring C3.ai and the newly highlighted semiconductor stock.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.