“`html

Is C3.ai Poised for a Breakthrough with Microsoft Partnership?

Growth investors often overlook a company’s less-than-stellar profits if they believe in its future potential. C3.ai (NYSE: AI) has attracted considerable attention as a promising player in the artificial intelligence (AI) sector. Despite its lack of profitability, this mid-cap stock has seen its value increase, driven by optimism about its diverse AI offerings catering to various industries. Recently, the company announced a significant partnership, exciting its CEO and investors alike. Could this be a chance to invest in C3.ai?

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

C3.ai’s Partnership with Microsoft: A Game-Changer?

C3.ai shared its most recent earnings in December, but recent buzz centers around its partnership with tech behemoth Microsoft. Just a month before, both companies announced a “strategic alliance” aimed at promoting AI adoption in enterprises.

Many organizations hesitate to invest in AI, unsure if it justifies the costs. This partnership could help both firms convince potential clients. C3.ai plans to place its enterprise AI applications on Microsoft’s Azure marketplace, potentially increasing its visibility and driving sales.

During C3.ai’s earnings call, CEO Tom Siebel touted this alliance as “the most significant event of the quarter and perhaps the most significant event in the company’s history.” He believes it will expedite the sales process and act as a strong motivator for future business growth.

While this could accelerate C3.ai’s growth, recent sales momentum hasn’t translated into a rising stock price. The crucial factor will be whether this deal leads the company closer to profitability.

Revenue Growth vs. Profitability: C3.ai’s Challenge

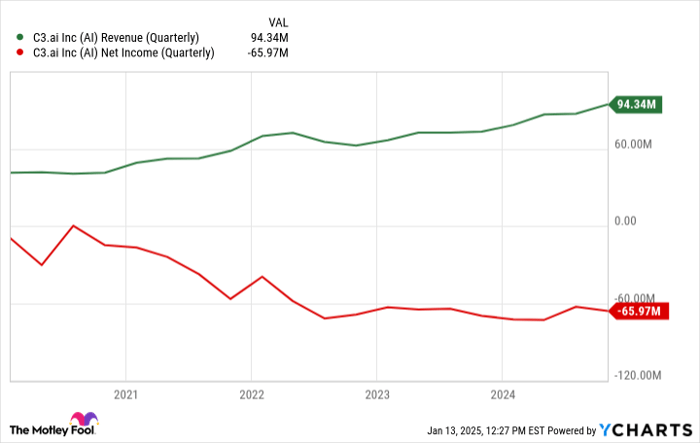

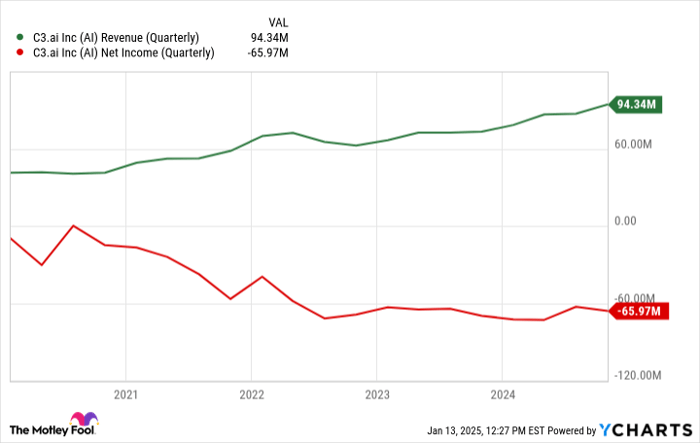

In its pursuit of increased sales, C3.ai has sidelined profitability. Siebel previously stated that as operations scale, profitability would be a “mathematical certainty.” Yet, despite rising sales, progress on the financial bottom line remains stagnant.

AI Revenue (Quarterly) data by YCharts

Instead of improving, C3.ai’s net income has decreased as sales grow. The Microsoft partnership may boost top-line revenue, but the main question remains: will it enhance profitability or lead to increased costs and losses?

Recently, C3.ai’s stock has dropped about 20%, signaling investor concerns about the company’s financial performance. Even with record sales figures, the absence of a clear path to profitability raises doubts about the company’s direction.

Is It Time to Buy C3.ai Stock?

C3.ai stocks have exhibited volatility over the past year. Although news of the Microsoft partnership generated initial excitement, the positive trend was short-lived. Without substantial growth in both revenue and profit to support claims of its significance, C3.ai may continue to face challenges.

Investors might be cautious until they see tangible improvements in profitability. For now, waiting on the sidelines could be the prudent choice for those wary of the risks involved with C3.ai.

Should You Invest $1,000 in C3.ai Now?

Before making any investments in C3.ai, consider the following:

The Motley Fool Stock Advisor analysts recently identified what they believe are the 10 best stocks to invest in, and C3.ai didn’t make the list. The selections have potential for significant returns in the coming years.

Remember when Nvidia was featured in this list on April 15, 2005… if you had invested $1,000 then, it would be worth $807,495!*

Stock Advisor offers an easy-to-follow investment guide, providing regular analyst updates and two new stock picks each month. Since its inception in 2002, the Stock Advisor service has achieved a return that is more than four times that of the S&P 500.*

See the 10 stocks »

*Stock Advisor returns as of January 13, 2025

David Jagielski has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Microsoft. The Motley Fool recommends C3.ai and suggests the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

“`