As C4 Therapeutics, Inc. (CCCC) gears up to release its fourth-quarter and full-year 2023 results, investors eagerly anticipate updates on its robust pipeline. The company has demonstrated a pattern of outperforming earnings expectations in recent quarters, underscoring its potential to surprise Wall Street again.

Owing to a blend of successes and missteps, C4 Therapeutics has averaged a 5.04% earnings surprise in the last year, with its most recent quarter yielding a remarkable 15.38% surprise.

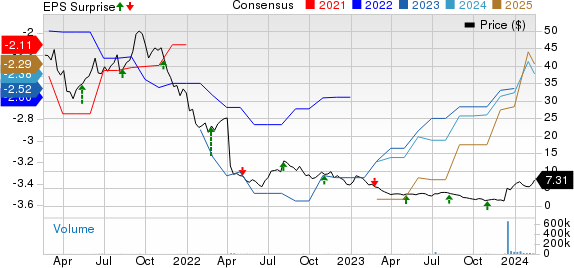

C4 Therapeutics, Inc. Price, Consensus and EPS Surprise

C4 Therapeutics, Inc. price-consensus-eps-surprise-chart | C4 Therapeutics, Inc. Quote

Focus on Pipeline Progress

Developing a new generation of small molecule medicines has been the focal point for C4 Therapeutics, leveraging its TORPEDO technology platform.

At present, the company’s most advanced product candidate, CFT7455, is carving a niche in clinical development for multiple myeloma and non-Hodgkin lymphomas, with encouraging clinical data presented in December 2023.

Apart from this, C4 Therapeutics is also actively developing CFT1946 and CFT8919, signifying a promising future if all goes according to plan.

Strategic Re-Alignment and Financial Projections

Last month, the company revealed strategic plans to streamline its drug development efforts in 2024. This move will involve prioritizing the advancement of specific pipeline candidates, accompanied by internal restructuring and a significant workforce reduction.

On the financial front, CCCC currently sits on around $330 million in unaudited cash, cash equivalents, and marketable securities as of January 5, 2024. This, combined with expected cost savings from restructuring, should be sufficient to fund operations into 2027.

Stock Performance and Market Expectations

Despite industry headwinds, CCCC’s stock trajectory has defied the odds, surging 120.8% in the last six months.

The general market sentiment, however, suggests a lack of consensus on an imminent earnings beat for CCCC.

Considerations for Investors

While C4 Therapeutics’ upcoming earnings report sees a cloud of skepticism, other drug and biotech stocks with positive earnings projections could offer more immediate promise. Companies like Arcus Biosciences (RCUS) present a compelling case for investors on the lookout for potential earnings surprises.

With the stage set for CCCC’s earnings announcement, it remains to be seen if the company can once again defy market expectations and deliver a positive surprise, or if the prevailing uncertainties will hold sway.

Riding the Wave of Earnings: Intellia Therapeutics and Ionis Pharmaceuticals

A Clear Winner in the Recent Months

Intellia Therapeutics (NTLA) shares have surged impressively by 13.6% in the past three months, suggesting a robust performance. The company currently boasts an Earnings ESP of +31.1% and a Zacks Rank #2, which undoubtedly reflects positively on its potential.

Steady Earnings Performances

NTLA has managed to beat earnings expectations in two of the trailing four quarters, delivering an average surprise of 5.04%, a testament to its consistent financial performance. With such a track record, the company appears to be on a trajectory towards sustained success.

On the other hand, Ionis Pharmaceuticals (IONS) has reported an Earnings ESP of +11.8% and holds a Zacks Rank #3 at present. With a solid history of beating earnings in three of the trailing four quarters, and delivering an average surprise of 28.07%, it comes as no surprise that IONS is set to release its fourth-quarter 2023 results on February 21, further underlining the market’s anticipation for its performance.

A Look at the Potential

Investors keen on keeping track of upcoming earnings announcements can leverage the Zacks Earnings Calendar to stay ahead of market movements and make informed decisions.

Is There a Clear Winner in the Making?

A standout option is one of “watershed medical breakthrough,” with a thriving pipeline dedicated to transforming the lives of individuals suffering from conditions involving the liver, lungs, and blood. This potential investment could position itself as a timely opportunity, particularly considering its recent emergence from bear market lows.

Comparing this to top-performing stocks of the recent past, such as Boston Beer Company, which experienced a remarkable surge of +143.0% in a mere 9 months, and NVIDIA, which skyrocketed by an impressive +175.9% within one year, the potential for a substantial gain becomes even more evident.

Ready to Uncover the Top Stock and Runners-Up?

Find the full article on Zacks.com here.

Please note that the views and opinions expressed herein are the author’s own and do not necessarily reflect those of Nasdaq, Inc.