Cadence Bank (CADE) fell short of expectations with its fourth-quarter 2023 adjusted earnings per share, reporting 40 cents, missing the Zacks Consensus Estimate of 53 cents. The bottom line, reflecting a decline of 48.7% year over year, places the company in a precarious financial position.

The company’s decision to sell Cadence Insurance, Inc. in the fourth quarter of 2023 greatly complicated its financials, presenting results from both continuing and discontinued operations. While an increase in deposit balances and an improved capital position provided some respite, a significant rise in expenses and a decline in revenues counteracted any positive outcomes.

Performance Summary

Adjusted net income from continuing operations available to common shareholders in the fourth quarter of 2023 plummeted to $72.7 million from $141.4 million in the year-ago quarter. For the full year 2023, adjusted earnings per share were $2.20 compared with $2.85 reported a year ago. Net income available to common shareholders increased to $532.8 million from $453.7 million in 2022.

Revenues Decline and Expenses Rise

The total adjusted revenues for the fourth quarter of 2023 were $408.8 million, down from $439.6 million in the year-ago quarter. This also missed the Zacks Consensus Estimate of $434 million. For the entire year, total adjusted revenues were $1.67 billion, a decline from $1.69 billion in the previous year, missing the estimates of $1.82 billion.

Net interest revenues in the quarter witnessed a substantial decrease, falling to $334.6 million, down 6.9% year over year. Contrastingly, total non-interest expenses increased by 6.7% year over year to $329.4 million, primarily due to FDIC special assessment fees.

Poor Credit Quality and Strong Capital Position

Non-performing loans and leases as of Dec 31, 2023, accounted for 0.67% of net loans and leases, significantly higher than the 0.35% as of Dec 31, 2022. The provision for credit losses in the quarter also witnessed a massive surge to $38 million from $6 million in the prior-year quarter. Non-performing assets stood at $222.4 million, a staggering 95% increase from the prior-year quarter.

On a brighter note, as of Dec 31, 2023, the tier 1 capital and tier 1 leverage capital ratios stood at 12.1% and 9.3%, respectively, compared with 10.7% and 8.4% at the end of the prior-year quarter. Moreover, the company’s total shareholders’ equity to total assets ratio increased to 10.56% at the end of the fourth quarter, up from 8.86% as of Dec 31, 2022, indicating a robust capital position.

Capital Deployment and Dividend Update

Cadence did not initiate any share repurchase activity in the reported quarter. However, concurrent with fourth-quarter earnings, the company’s board of directors declared cash dividends of 25 cents per common share, reflecting a sequential rise of 6.4%. The dividend is scheduled for payment on Apr 1, 2024, to shareholders of record as of Mar 15, 2024.

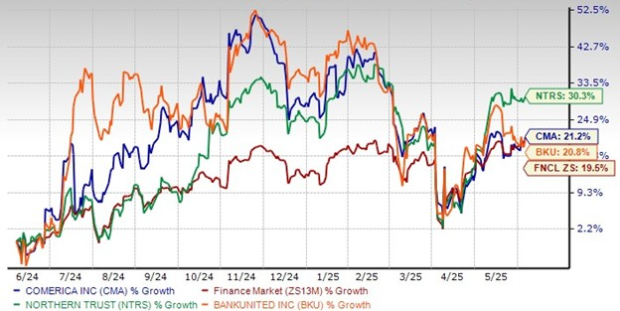

Market Sentiment and Comparison

Despite the challenging performance, Cadence Bank carries a Zacks Rank #3 (Hold). Other bank entities such as East West Bancorp and Webster Financial also faced challenges. East West Bancorp reported a decline in bottom line, while Webster Financial reported in-line earnings per share, both facing difficulties related to their revenues and expenses. The tough times seem pervasive in the banking sector.

Conclusion

While Cadence Bank exhibited areas of strength such as an improvement in deposit balances and capital position, the company’s performance suffered from a rise in expenses and a decline in revenues. The company’s prowess seemed hampered, indicating a tumultuous journey ahead, and investors need to proceed with caution.

Cadence’s poor financial results do not bode well and their upcoming performance will be critical for all stakeholders. The prospects of this financial institution hinge on its ability to navigate through these tumultuous times in the banking sector, amid fluctuating interest rates and market volatility.

It remains to be seen how the institution, with its newfound dividend and financial constraints, negotiates its way through these stormy waters. There’s much for the company to consider, for the tide could either sweep Cadence along or sink it without a trace.