Can You Become a Millionaire through a 401(k)? Here’s How

Do you aspire to become a millionaire but feel that your average job and paycheck might not get you there? Don’t dismiss your chances just yet.

Many individuals have surprised themselves as their retirement accounts reached seven figures. In such instances, time plays a crucial role in building wealth.

Where to invest $1,000 right now? Our analyst team has identified the 10 best stocks to buy today. Learn More »

In this context, let’s explore what it takes to accumulate $1 million in your workplace 401(k) over a 30-year career.

Understanding the Numbers

While a 401(k) isn’t your only retirement savings option, it often stands out as a top choice for various reasons.

For starters, 401(k) plans feature significantly higher contribution limits than IRAs. In 2025, individuals can contribute up to $23,500 into a 401(k), or $31,000 for those aged 50 and over. In comparison, traditional and Roth IRA limits are capped at $7,000, increasing to $8,000 for those aged 50 and above.

Another compelling reason to prioritize a 401(k) is the potential for employer matching contributions. According to Fidelity, in Q3 of the previous year, employers contributed an average of $1,240 to their workers’ 401(k) plans, whereas employees contributed an average of $2,350.

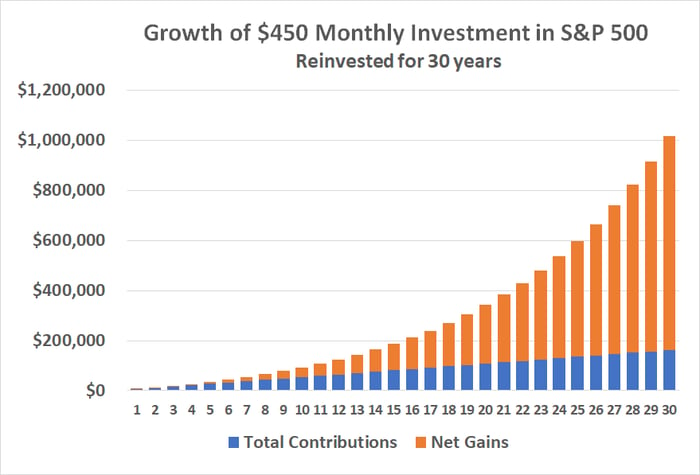

This leads us to the essential question: How much should you contribute monthly to reach $1 million in a 401(k) over 30 years? As illustrated in the graphic, investing $450 per month in an S&P 500 index fund, which historically offers an average annual return of 10%, would achieve this goal.

Data source: Calculator.net. Chart by author.

Keep in mind that while money in a 401(k) grows tax-free, it is taxable upon withdrawal unless you have a Roth 401(k).

Looking Ahead

It’s important to consider that $1 million in 30 years may not carry the same purchasing power as it does today. Assuming an annual inflation rate of about 3%, the equivalent in 2055 would be close to $2.5 million.

Additionally, remember that contributing $450 per month today would feel more like $1,000 per month back in 1995 when accounting for inflation.

On a positive note, as you progress in your career and hopefully grow your income beyond inflation, you can increase your contributions to your 401(k). This analysis illustrates that a seven-figure nest egg is more achievable than you might think.

Review the graphic once more to see how time influences this process. Notably, the investment gains only began to surpass annual contributions roughly two-thirds through the 30-year period. As a result, significant growth in your account value occurs during the last six years of this timeline.

Take Action

One caveat: Your investment journey won’t mirror the steady rise depicted in the chart, which assumes a consistent 10% gain per year. In reality, investment growth might fluctuate significantly year to year.

However, over an extended period, the average annual gain of 10% remains a reliable expectation.

The key takeaway is that building a million-dollar retirement plan is not as unreachable as it might seem. Even if you cannot set aside $450 every month or don’t have a full 30 years for investing, starting with any amount is better than doing nothing. Establish a sensible budget for savings now, and consider increasing your contributions in the future.

The $22,924 Social Security Bonus Most Retirees Overlook

If you’re like many Americans, you may be behind on your retirement savings. However, several lesser-known “Social Security secrets” could increase your retirement income. For instance, one easy trick may provide up to $22,924 more annually. By maximizing your Social Security benefits, you can aim for a confident and secure retirement. Click here to explore these strategies.

View the “Social Security secrets” »

James Brumley has no position in any stocks mentioned. The Motley Fool has no position in any stocks discussed. Their disclosure policy is available.

The views contained in this article are solely those of the author and do not necessarily reflect those of Nasdaq, Inc.