Analysts Project Significant Upside for ProShares SMDV ETF

At ETF Channel, we have analyzed the underlying holdings of various ETFs to determine their potential for growth. This includes comparing the trading price of each holding against the average 12-month forward target price set by analysts. For the ProShares Russell 2000 Dividend Growers ETF (Symbol: SMDV), our findings indicate an implied analyst target price of $79.18 per unit based on its underlying holdings.

Currently, SMDV trades at approximately $58.95 per unit, suggesting analysts anticipate a potential upside of 34.32% based on these targets. Notably, three of SMDV’s underlying holdings exhibit significant upside according to analyst expectations: Enpro Inc (Symbol: NPO), Cohen & Steers Inc (Symbol: CNS), and Orrstown Financial Services, Inc. (Symbol: ORRF). Enpro Inc trades at $137.27 per share, with an average analyst target of $222.50 per share, representing a 62.09% upside. Similarly, Cohen & Steers Inc has a recent price of $70.16 and a forecasted average target of $106.50, translating to an estimated 51.80% upside. Lastly, Orrstown Financial Services, Inc. is priced at $26.47, with analysts expecting it to reach $40.00, indicating a potential 51.11% increase.

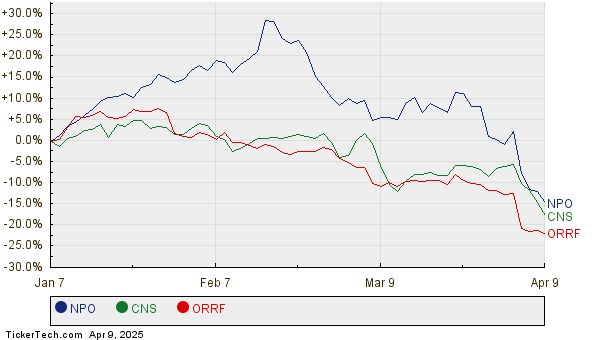

Below is a twelve-month price history chart that compares the performances of NPO, CNS, and ORRF:

We have summarized the current analyst target prices for the discussed stocks in the table below:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| ProShares Russell 2000 Dividend Growers ETF | SMDV | $58.95 | $79.18 | 34.32% |

| Enpro Inc | NPO | $137.27 | $222.50 | 62.09% |

| Cohen & Steers Inc | CNS | $70.16 | $106.50 | 51.80% |

| Orrstown Financial Services, Inc. | ORRF | $26.47 | $40.00 | 51.11% |

There are important questions regarding analysts’ target prices. Are these targets justified based on recent company and industry developments? While high target prices can reflect optimism, they may also suggest a potential for downgrades if they don’t align with current market realities. It’s essential for investors to conduct thorough research before making decisions.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

also see:

ETFs Holding BHP

Institutional Holders of MHNB

ETFs Holding AVGO

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.