Analysts Predict Upside for First Trust Rising Dividend Achievers ETF

In our recent evaluation of ETFs at ETF Channel, we analyzed the underlying holdings of the First Trust Rising Dividend Achievers ETF (Symbol: RDVY) by comparing their trading prices to average analyst 12-month forward target prices. This assessment yielded an implied analyst target price of $66.44 per unit for RDVY.

Current Pricing and Analyst Projections

As RDVY trades at approximately $60.65 per unit, analysts project a potential upside of 9.55%, based on average target prices for the underlying holdings. Key contributors to this optimistic outlook include Steel Dynamics Inc. (Symbol: STLD), Cognizant Technology Solutions Corp. (Symbol: CTSH), and Apple Inc. (Symbol: AAPL). Despite STLD’s recent trading price of $133.72/share, its average analyst target stands at $147.00/share, indicating a 9.93% upside. Likewise, CTSH shows a 9.70% upside from a current price of $80.36, targeting $88.16/share. Analysts anticipate AAPL’s price to reach $232.78/share, representing a 9.63% increase from its recent price of $212.33.

Performance Comparison

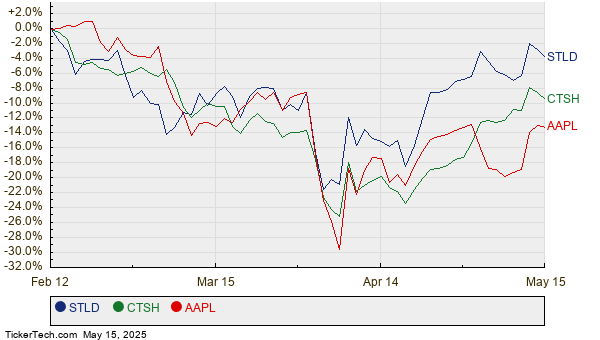

Below is a twelve-month price history chart illustrating the stock performance of STLD, CTSH, and AAPL:

Summary of Analyst Target Prices

Here is a table summarizing the current analyst target prices for the discussed stocks:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| First Trust Rising Dividend Achievers ETF | RDVY | $60.65 | $66.44 | 9.55% |

| Steel Dynamics Inc. | STLD | $133.72 | $147.00 | 9.93% |

| Cognizant Technology Solutions Corp. | CTSH | $80.36 | $88.16 | 9.70% |

| Apple Inc | AAPL | $212.33 | $232.78 | 9.63% |

Evaluating Analyst Optimism

Are analysts justified in these targets or too optimistic regarding where these stocks will trade in the next 12 months? Investors should investigate whether these price targets are supported by recent developments in the companies and their respective industries. A high target price relative to a stock’s current trading price might indicate optimism, yet it could also signal potential downgrades if these targets no longer reflect current market conditions.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

also see:

• Waste Management Dividend Stocks

• VNTV Historical Stock Prices

• Funds Holding EDR

The views and opinions expressed herein are those of the author and may not necessarily reflect those of Nasdaq, Inc.