Analysts Predict Significant Upside for iShares SMLF ETF

In our latest analysis at ETF Channel, we evaluated the holdings of various ETFs. Specifically, for the iShares U.S. Small-Cap Equity Factor ETF (Symbol: SMLF), we’ve determined an implied analyst target price of $77.43 per unit based on its underlying assets.

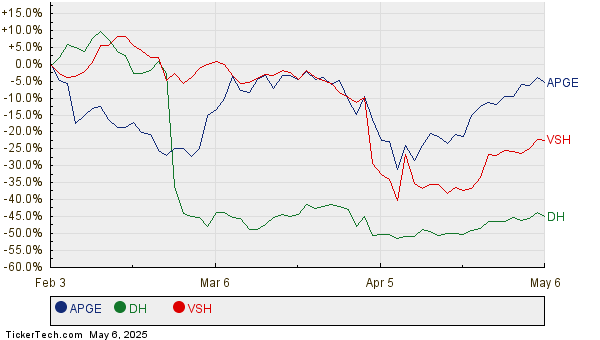

Currently trading at approximately $62.65 per unit, SMLF offers a projected 23.59% upside according to analyst target averages. Among SMLF’s holdings, three companies stand out with significant upside potential: Apogee Therapeutics Inc (Symbol: APGE), Definitive Healthcare Corp (Symbol: DH), and Vishay Intertechnology, Inc. (Symbol: VSH). For instance, APGE has a recent trading price of $39.39 per share, while the average target is considerably higher at $93.88 per share, indicating a potential increase of 138.32%. Similarly, DH’s current price of $2.77 suggests a 71.48% upside to the average target of $4.75. Furthermore, analysts expect VSH to reach a target price of $18.00 per share, which is 31.68% above its recent price of $13.67.

Below is a twelve-month price history chart for APGE, DH, and VSH:

Here is a summary of the current analyst target prices:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| iShares U.S. Small-Cap Equity Factor ETF | SMLF | $62.65 | $77.43 | 23.59% |

| Apogee Therapeutics Inc | APGE | $39.39 | $93.88 | 138.32% |

| Definitive Healthcare Corp | DH | $2.77 | $4.75 | 71.48% |

| Vishay Intertechnology, Inc. | VSH | $13.67 | $18.00 | 31.68% |

Are these analyst targets well-founded or overly optimistic? It’s essential for investors to consider the rationale behind these projections in light of recent company performance and industry trends. A high target relative to a stock’s price can signal optimism but may also foreshadow downgrades if the expectations do not align with market realities. Investors should conduct further research to assess these targets.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

See:

▶ Top Ten Hedge Funds Holding EQD

▶ Top Ten Hedge Funds Holding CTLP

▶ HTBX shares outstanding history

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.