Analysts Predict Strong Upside for SLYV and Key Holdings

ETF Channel has examined the holdings of various ETFs to compare their trading prices with the average analyst target prices. We focused on the SPDR S&P 600 Small Cap Value ETF (Symbol: SLYV), which has an impressive implied target price of $104.62 per unit based on its underlying assets.

Current Pricing and Future Expectations

SLYV is currently trading at approximately $89.62 per unit, indicating a potential upside of 16.74% according to analysts. Noteworthy among its underlying holdings are Amphastar Pharmaceuticals Inc (Symbol: AMPH), REX American Resources Corp (Symbol: REX), and Worthington Steel Inc (Symbol: WS). For instance, AMPH is priced at $36.39 per share, while analysts project a target price of $56.40, which represents an upside potential of 54.99%. REX, trading at $41.20, has a target price of $55.00, suggesting a 33.50% increase. Meanwhile, WS is at $29.99, with a target of $40.00—showing potential growth of 33.38%.

Performance Snapshot

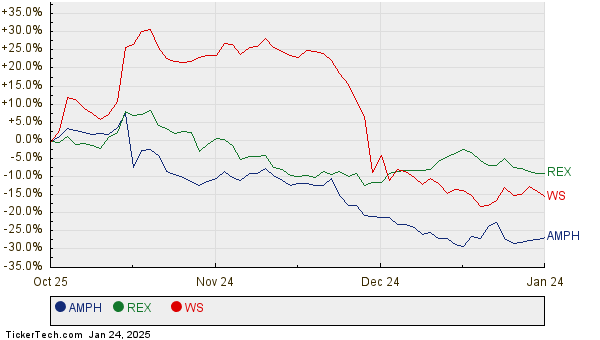

Below is a twelve-month price history chart highlighting the stock performance of AMPH, REX, and WS:

Analyst Target Summary

Here’s a summary of the current analyst target prices:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| SPDR S&P 600 Small Cap Value ETF | SLYV | $89.62 | $104.62 | 16.74% |

| Amphastar Pharmaceuticals Inc | AMPH | $36.39 | $56.40 | 54.99% |

| REX American Resources Corp | REX | $41.20 | $55.00 | 33.50% |

| Worthington Steel Inc | WS | $29.99 | $40.00 | 33.38% |

Investor Considerations

Are these projected targets realistic, or do they reflect excessive optimism? It’s essential for investors to consider if analysts have valid reasons for their projections or if they are lagging behind recent developments in companies and their sectors. High targets may signify confidence in future growth, but they can also lead to sharp downgrades if based on outdated insights. Investors are encouraged to conduct thorough research before making decisions.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• CBTX Stock Predictions

• Procter and Gamble YTD Return

• CNXC shares outstanding history

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.