Fidelity Enhanced Mid Cap ETF Shows 10.95% Upside Potential

Analysts Evaluate FMDE Against Its Underlying Holdings

In a detailed analysis of exchange-traded funds (ETFs) at ETF Channel, we examined the trading prices of constituent holdings alongside the average 12-month analyst target prices. For the Fidelity Enhanced Mid Cap ETF (Symbol: FMDE), the calculated implied analyst target price stands at $37.87 per unit.

FMDE’s Current Price Signals Potential Growth

Currently trading near $34.13 per unit, FMDE indicates a potential upside of 10.95% based on the average targets of its underlying assets. Among these, three holdings show particularly strong upward potential: Gates Industrial Corp PLC (Symbol: GTES), Gaming & Leisure Properties, Inc (Symbol: GLPI), and Viper Energy Inc (Symbol: VNOM). Gates Industrial shares are valued at $20.49, while the average analyst target is $23.55, representing a 14.91% upside. Similarly, GLPI’s recent price of $48.05 suggests a 13.86% upside to its target of $54.71. Viper Energy’s current share price of $51.37 reflects a potential 12.77% increase compared to its analyst target of $57.93.

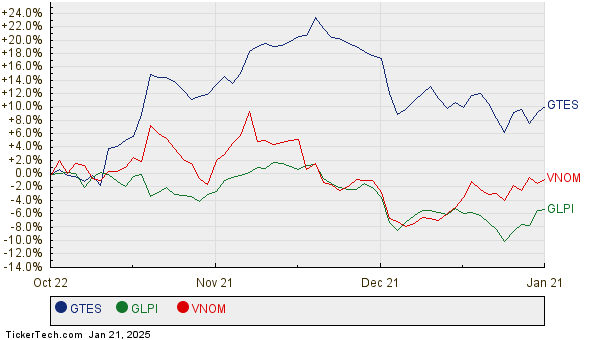

Below is a twelve-month price performance chart for GTES, GLPI, and VNOM:

Summary of Analyst Target Prices

Here is a summary table showcasing the current analyst target prices for the mentioned holdings:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Fidelity Enhanced Mid Cap ETF | FMDE | $34.13 | $37.87 | 10.95% |

| Gates Industrial Corp PLC | GTES | $20.49 | $23.55 | 14.91% |

| Gaming & Leisure Properties, Inc | GLPI | $48.05 | $54.71 | 13.86% |

| Viper Energy Inc | VNOM | $51.37 | $57.93 | 12.77% |

Are Analysts’ Predictions Realistic?

The question remains: Do analysts have solid grounds for their target prices, or are they being overly optimistic? A high target price in comparison to a company’s trading price may signal future potential but could also lead to lowered expectations if conditions change. Investors should conduct thorough research to gauge the validity of these forecasts.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• MSA Dividend Growth Rate

• Applied Digital Past Earnings

• LMDX Videos

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.