Nvidia’s Explosive Growth: A Look Back at 2015 Investment Choices

In 2015, investors faced a pivotal moment: Many chose to buy shares of Nvidia (NASDAQ: NVDA). While some seized the opportunity, a significant number did not. Regardless, the choice to invest or not would carry long-term consequences.

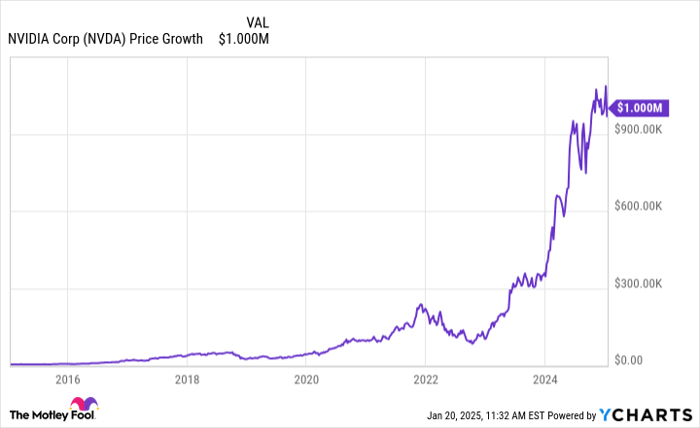

For those who opted out, the present may bring feelings of regret. Nvidia has emerged as a standout in the stock market. Investors who bought and held onto Nvidia shares have likely seen their wealth multiply significantly. Discover how much it would take to reach millionaire status by investing in Nvidia a decade ago.

Where to invest $1,000 right now? Our analysts have identified the 10 best stocks to buy today. See the 10 stocks »

A Minimal Initial Investment for Major Returns

Most investors would be thrilled with a stock that becomes a 10-bagger over ten years. However, Nvidia’s growth since January 2015 has been astonishing, with a gain of 28.5x. This remarkable increase highlights how transformative a successful investment decision can be.

Moreover, Nvidia’s total return improves even more when including dividends, which the company initiated in 2012. Although the yield is modest, reinvesting dividends over the years has paid substantial dividends, culminating in a total return exceeding 29.6x over the past decade.

To reach the millionaire mark with a stock yielding a 29.6x return, the initial investment may astound you. Investing just $3,625 in Nvidia in January 2015 would mean a fortune of $1 million today.

NVDA data by YCharts

While $3,625 may seem like considerable capital for many, it averages to less than $10 per day over the course of a year ($9.93 to be precise). Many could likely manage this amount, especially knowing it could lead to millionaire status in just ten years.

Indicators of Nvidia’s Future Success in 2015

At the time, most investors could not have predicted Nvidia’s impressive trajectory. Yet, several early signs suggested a strong potential for success. For instance, Nvidia’s quarterly regulatory filing in early 2015, detailing its third-quarter results for fiscal 2015, highlighted data centers as a key market target. The company mentioned, “the world’s 15 most highly efficient supercomputers all utilizing our Tesla GPUs,” reflecting their growing presence in the data center market.

Additionally, Nvidia’s graphics processing units (GPUs) were recognized for their critical role in artificial intelligence (AI), a trend that was gaining traction. In its annual report from March 2015, the company referenced its chips’ applications in deep learning multiple times, underscoring their value within AI contexts.

In fact, the AI industry’s rapid progress was unsurprising; a report from Pew Research Center in August 2014 predicted significant advancements in AI and robotics by 2025. David Orban, the CEO of DotSUB, touched on this idea, asserting, “It will be natural to talk to computers of any shape…” which reflected an emerging vision of AI capabilities.

Nvidia’s Future as a Potential Millionaire Maker

Could a $3,625 investment today in Nvidia stock still yield millionaire potential in 10 years? Likely not. Nonetheless, it’s plausible Nvidia will remain a valuable investment for those with the capital to invest, particularly those prepared to allocate $200,000 or more over the next two decades.

The demand for Nvidia’s GPUs continues to rise, especially in AI training and deployment. As the company introduces new, more powerful chips quicker than before, the prospects for artificial general intelligence (AGI) within a few years could further expand Nvidia’s market potential.

However, investors seeking an alternative stock that has similar potential may need to look beyond Nvidia. Opportunities within the quantum computing sector might present such a chance.

A New Opportunity Awaits

Have you ever felt left out of the most profitable investment opportunities? If so, the following information may be invaluable.

Occasionally, our team of analysts issues a “Double Down” stock recommendation, targeting companies they believe are on the verge of significant growth. If you feel you’ve missed your chance, now might be the best opportunity to invest before it slips away. Consider the impressive returns:

- Nvidia: If you had invested $1,000 when we doubled down in 2009, you’d have $357,084!*

- Apple: If you had invested $1,000 when we doubled down in 2008, you’d have $43,554!*

- Netflix: If you had invested $1,000 when we doubled down in 2004, you’d have $462,766!*

Currently, we’re issuing “Double Down” alerts for three remarkable companies, making this a timely opportunity for investment.

See 3 “Double Down” stocks »

*Stock Advisor returns as of January 13, 2025

Keith Speights has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.