Cameco Faces Challenges Amid Falling Uranium Prices and Stock Decline

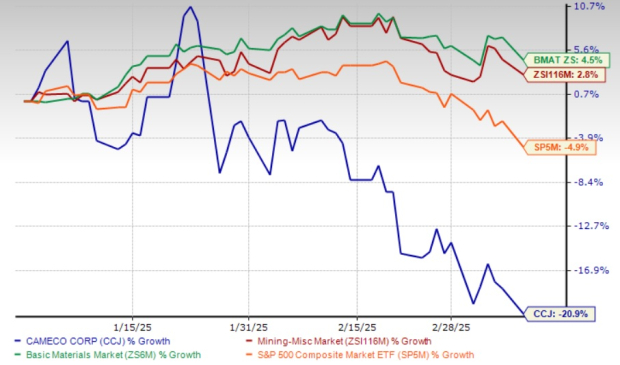

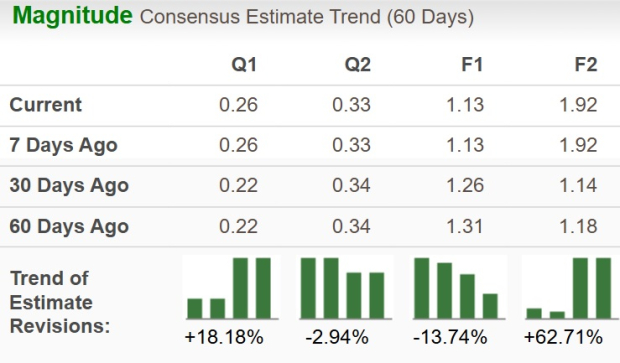

Cameco CCJ shares have decreased by 20.9% year to date, contrasting with the industry’s 2.8% return and the Zacks Basic Materials sector’s 4.5% growth. In comparison, the S&P 500 has dipped by 4.9%.

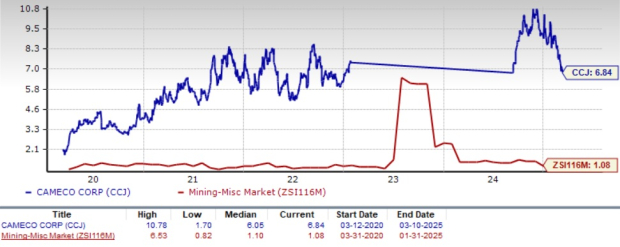

Cameco’s Year-to-Date Price Performance

Image Source: Zacks Investment Research

The decline in Cameco stock correlates with a substantial 29% drop in uranium prices over the past year, including a 12% decrease thus far this year. Concerns regarding its joint venture at Inkai in Kazakhstan have also negatively impacted the stock. In contrast, peer Centrus Energy LEU has seen an 11% increase in its stock price this year.

Currently, the CCJ stock trades below both its 50-day and 200-day moving averages. The recent “death crossover,” marked on March 4, 2025, continues to suggest a bearish trend as the 50-day SMA is less than the 200-day SMA.

CCJ Shares Below 50-Day and 200-Day SMAs

Image Source: Zacks Investment Research

With Cameco’s significant stock pullback, investors may feel inclined to consider purchasing the shares. However, assessing the company’s strengths and weaknesses is essential before taking action.

Cameco’s Fiscal Year 2024 Earnings Show 24% Decline

In fiscal year 2024, CCJ’s revenues increased by 21% year over year to $2.2 billion (CAD $3.14 billion), driven by enhanced sales volumes and improved average realized prices.

Within the uranium segment, sales volume saw a 5% growth, while prices rose by 17%, resulting in a 24% increase in overall revenues. The Fuel Services division also recorded an 8% revenue increase due to a 1% rise in sales volume and a 6% price hike throughout the year. However, while the uranium segment reported a 41% increase in adjusted EBITDA, the Fuel Services segment experienced a 12% decline.

The company posted adjusted earnings per share of 47 cents (CAD 0.67), marking a 24% year-over-year decrease but exceeding the consensus estimate of 42 cents. The decline was largely a result of purchase accounting related to the acquisition of Westinghouse.

Cameco is focused on ramping up its tier-one assets and enhancing performance and reliability. The company targets a production of 18 million pounds of uranium (on a 100% basis) at both the McArthur River/Key Lake and Cigar Lake sites in 2025, along with 13 to 14 million kgU in the Fuel Services segment during the same year.

For 2025, CCJ forecasts uranium deliveries between 31 and 34 million pounds, primarily in the latter half of the year. The anticipated revenues for 2025 range from $3.3 billion to $3.55 billion, with its share of Westinghouse’s adjusted EBITDA estimated between $355 million and $405 million.

Challenges from Inkai Impact CCJ Performance

In 2024, Cameco’s share of production reached 23.4 million pounds, slightly above its forecast of 23.1 million pounds, largely due to record output from the Key Lake mill. However, production at Inkai was 7.8 million pounds (with Cameco’s share being 3.6 million pounds), falling 0.6 million pounds short of 2023 figures due to persistent supply-chain issues in Kazakhstan.

Production at Inkai was temporarily halted on January 1 due to regulatory delays in Kazakhstan, though it resumed on January 23. Nevertheless, CCJ acknowledged uncertainty in its production plans for 2025 and beyond.

Additionally, effective 2025, Kazakhstan is set to implement an increase in the Mineral Extraction Tax (MET) for uranium, raising the rate from 6% to 9%. From 2026 onward, the tax will be based on both production and spot prices.

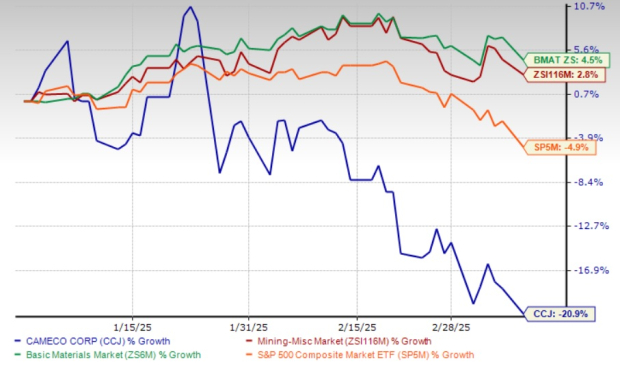

Cameco’s Earnings Estimate Revision Activity Mixed

The Zacks Consensus Estimate for Cameco’s earnings for 2025 has decreased over the past 60 days, while estimates for fiscal year 2026 have increased, as illustrated in the chart below.

Image Source: Zacks Investment Research

Uranium Price Decline Worries Market for CCJ

Uranium prices have continued to decline, currently standing at $65.40 per pound. This downward trend is exacerbated by a sufficient supply and uncertainty surrounding demand.

Reports indicate that Microsoft MSFT has canceled several data center leases in the U.S., contradicting expectations that tech companies are securing substantial new power capacity. This news raises additional concerns about future uranium demand.

Cameco’s Stock Valuation Appears Elevated

The CCJ stock is trading at a forward price-to-sales ratio of 6.84, compared to the industry’s ratio of 1.08. This valuation surpasses its five-year median of 6.05.

Image Source: Zacks Investment Research

Furthermore, the company’s Value Score of F indicates that the stock is not trading at a competitive valuation at the moment.

Long-Term Prospects for Cameco Remain Strong

Cameco is committed to maintaining financial strength and flexibility to bolster production and capitalize on market opportunities. Efforts are ongoing to extend the mine life at Cigar Lake until 2036. Additionally, CCJ aims to increase production at McArthur River and Key Lake from 18 million pounds to its licensed annual capacity of 25 million pounds (on a 100% basis).

Geopolitical developments, energy security concerns, and the rising demand for low-carbon energy in light of the climate crisis are supporting the nuclear power sector. With its low-cost, high-grade assets and a diversified portfolio covering the nuclear fuel cycle, Cameco is positioned to take advantage of these trends.

Final Thoughts on Cameco’s Stock

Backed by a solid balance sheet, the company is actively investing to enhance its growth potential and deliver value to shareholders.

Market Insights: Challenges for Cameco Corporation and Uranium Demand

Amid increasing expectations for uranium demand, it’s crucial to assess Cameco Corporation (CCJ) and its current market situation. Ongoing challenges at the Inkai project, repercussions from the new Mineral Extraction Tax (MET) implemented by the Kazakhstan government, and CCJ’s premium valuation suggest that selling the stock may be a wise decision at this time. Currently, Cameco holds a Zacks Rank of #5 (Strong Sell).

Investors may also find value in reviewing the complete list of today’s Zacks #1 Rank (Strong Buy) stocks for potential opportunities.

Zacks’ Research Chief Highlights Stock with Potential for Growth

Zacks Investment Research has released insights on five stocks with the highest likelihood of achieving a +100% gain in the upcoming months. Among these, Director of Research Sheraz Mian emphasizes one stock that is particularly well-positioned for significant growth.

This standout option is from an innovative financial firm with a rapidly expanding customer base of over 50 million. Offering a range of cutting-edge solutions, this stock is anticipated to generate substantial returns. While not all recommended stocks achieve success, this one has the potential to exceed previous Zacks recommendations, such as Nano-X Imaging, which saw a rise of +129.6% in just over nine months.

To discover the top stock along with four additional contenders, you can view our exclusive report.

For those seeking the latest investment recommendations, today you can download Zacks’ report on the 7 Best Stocks for the Next 30 Days.

Other stocks to consider include:

- Microsoft Corporation (MSFT): View Stock Analysis

- Cameco Corporation (CCJ): View Stock Analysis

- Centrus Energy Corp. (LEU): View Stock Analysis

This article was originally published by Zacks Investment Research (zacks.com).

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.