Alphabet’s Q3 Surge: Is a Stock Buy Justified?

Alphabet’s GOOGL reported impressive third-quarter results yesterday, pushing its stock to a three-month high of over $180 a share. However, it pulled back slightly, declining by -2% during Thursday’s trading session.

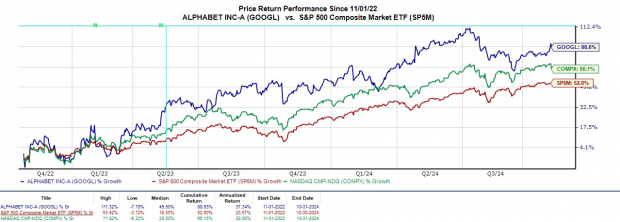

Despite the slight drop, GOOGL has consistently outperformed wider market indexes over the past two years. Investors are now questioning if this is the right moment to purchase Alphabet’s stock after it clearly outstripped Q3 expectations and delivered remarkable growth.

Image Source: Zacks Investment Research

Strong Performance in Q3

In Q3, Alphabet reported sales of $74.54 billion, exceeding estimates of $72.84 billion by 2%, and representing a 16% increase from $64.05 billion in the same quarter last year. This growth was particularly driven by its Google Services segment, encompassing Google Search, along with increased revenue from YouTube ads and Google Cloud. Additionally, advancements in AI Infrastructure and Generative AI solutions significantly contributed to this expansion.

Alphabet’s Q3 earnings per share (EPS) also impressively reached $2.12, surpassing forecasts of $1.83 per share by nearly 16%. Moreover, this represented a 37% increase from $1.55 per share during the same period last year.

The company has now beaten the Zacks EPS Consensus for seven consecutive quarters, achieving an average earnings surprise of 11.84% over its last four quarterly reports.

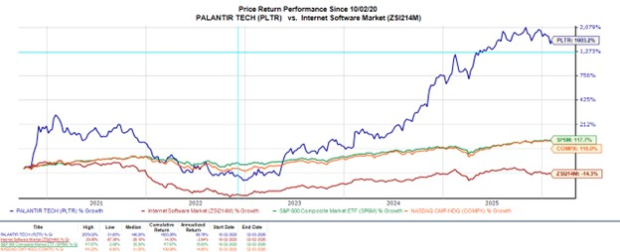

Image Source: Zacks Investment Research

Reasons to Consider GOOGL

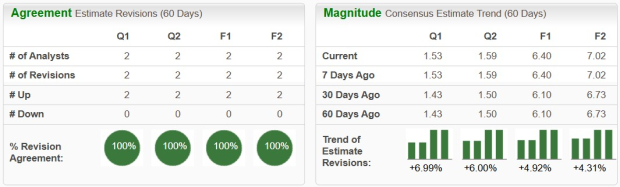

Analysts are starting to reaffirm projections of double-digit top and bottom-line growth for fiscal years 2024 and 2025. Alphabet’s current valuation further supports the argument that now may be an opportune time to invest in GOOGL.

With the lowest forward P/E ratio (22.8X) among the top “Magnificent 7” tech stocks, it’s also encouraging that EPS estimates for both FY24 and FY25 have risen in the past month.

Image Source: Zacks Investment Research

Concluding Thoughts

Investing in one of the “Magnificent 7” tech stocks, while it trades below the benchmark S&P 500’s forward earnings multiple of 24.7X, presents an attractive opportunity. Given the positive trend of earnings estimate revisions following its strong Q3 results, Alphabet’s stock could be on the verge of another upward movement, currently holding a Zacks Rank of #2 (Buy).

5 Stocks Set to Double

Each stock in this report has been selected by a Zacks expert as a leading candidate to gain +100% or more in 2024. While not all recommendations are guaranteed to succeed, past selections have soared +143.0%, +175.9%, +498.3%, and +673.0%.

Most of these stocks are flying under Wall Street’s radar, presenting a significant opportunity to buy in early.

Discover These 5 Potential Home Runs >>

Get a Free Stock Analysis Report for Alphabet Inc. (GOOGL).

Read the full article on Zacks.com.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.