Is Bristol-Myers Squibb a Smart Choice for Your Investment Portfolio?

Bristol-Myers Squibb (NYSE: BMY) stands as a significant option for investors aiming to build wealth slowly and steadily. With a broad range of treatments available and a pipeline of promising developments, the company is positioned to continue meeting global healthcare needs.

However, not every well-established company translates into a perfect investment. It is important to assess this stock’s potential for wealth creation critically.

Ways Bristol-Myers Squibb Could Contribute to Wealth Accumulation

While Bristol-Myers might not turn anyone into a millionaire instantly, it still holds promise over the long run.

The company’s market capitalization exceeds $118 billion, and in 2023, its revenue reached $45 billion with a net income of nearly $8 billion. Due to this substantial scale, rapid growth prospects remain a challenge; the pharmaceutical research and development (R&D) cycle typically spans about seven years. This extended timeline delays potential revenue from innovative programs.

Nevertheless, Bristol-Myers can support long-term financial goals. As one of the leading pharmaceutical developers globally, it is resilient enough to weather market fluctuations, offering potential for stable income through dividends.

The forward dividend yield is about 4.1%. Over the past decade, the company increased its dividend payout by 62.1%. Management is committed to maintaining this dividend, with a payout ratio of approximately 60% at present.

While the yield may not be outstanding for a dividend stock, long-term investors could see increased yields as market pressures affect the share price. Additionally, the dividend payments are likely to rise in the foreseeable future.

Investors may also benefit from share price appreciation. Bristol-Myers has around $5 billion authorized for share repurchases. While immediate capital for additional buybacks may not be available, future opportunities might present themselves, serving as another growth driver.

Other Stocks May Offer Greater Wealth-Building Potential

In reality, other stocks may present stronger wealth-building opportunities than Bristol-Myers Squibb.

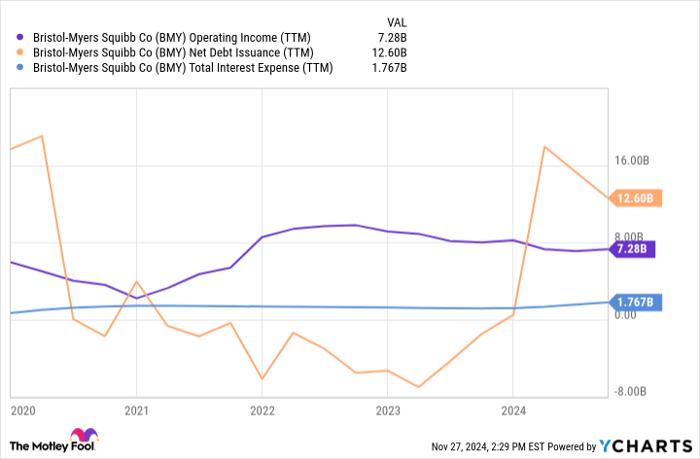

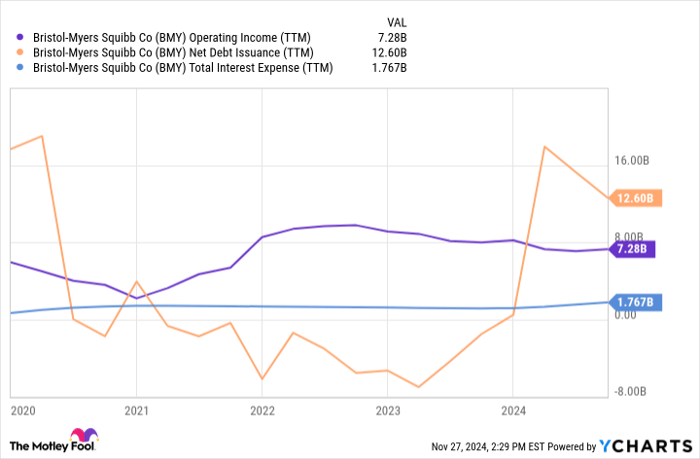

Take a look at the chart below as evidence:

BMY Operating Income (TTM) data by YCharts

Over the past five years, Bristol-Myers’ trailing-12-month (TTM) operating income increased by just 23%. In contrast, its debt levels have risen considerably, with a corresponding increase in interest payment obligations. Management indicates that maintaining current growth rates in the long term may pose challenges, likely resulting in rising interest payments that could hinder growth further.

To cope with these pressures, Bristol-Myers might have to resort to additional borrowing to support riskier R&D initiatives, which heightens the risk for investors.

Looking ahead, the company’s pipeline largely focuses on specialized oncology and immunology treatments, which limits chances for groundbreaking drugs that could deliver substantial returns if they gain approval. Developing new technologies or possibly acquiring biotech companies may be necessary for faster expansion, leading to increased risks for current investors.

Thus, prospective investors should temper expectations regarding quick wealth generation from Bristol-Myers stock. While unexpected changes in strategy could occur, betting on this company may not be the most prudent approach right now.

Is Now the Time to Invest $1,000 in Bristol-Myers Squibb?

Before deciding to purchase stock in Bristol-Myers Squibb, it’s worth considering this:

The Motley Fool Stock Advisor team has identified what they believe are the 10 best stocks to invest in at this moment—Bristol-Myers Squibb is not among them. The selected stocks have the potential to yield substantial returns in the coming years.

For example, Nvidia made this list on April 15, 2005. If you had invested $1,000 at that time, your investment would be worth $847,211!*

Stock Advisor offers an accessible framework for success, including portfolio-building tips, regular analyst updates, and two new stock recommendations each month. Since its inception in 2002, Stock Advisor has more than quadrupled the returns of the S&P 500.*

Explore the 10 stocks »

*Stock Advisor returns as of November 25, 2024

Alex Carchidi has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Bristol Myers Squibb. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.