Mastercard Incorporated (MA) announced on [Date] a significant enhancement to its network services in the Asia Pacific region, enabling banks and fintech companies to onboard up to four times faster through Mastercard Cloud Edge. This cloud-based connectivity solution, developed with major cloud providers like Amazon Web Services (AWS), aims to streamline the deployment of modern payment capabilities across various markets including India, Australia, Singapore, Hong Kong SAR, and Thailand.

The platform helps organizations to access private network connections, avoiding reliance on legacy systems while complying with regional data storage laws. Mastercard reported that its value-added services and solutions have seen a 16% year-over-year revenue growth in Q1 2025. The fintech sector in the Asia Pacific is expected to drive adoption of this new service, thus potentially increasing Mastercard’s customer base in the region.

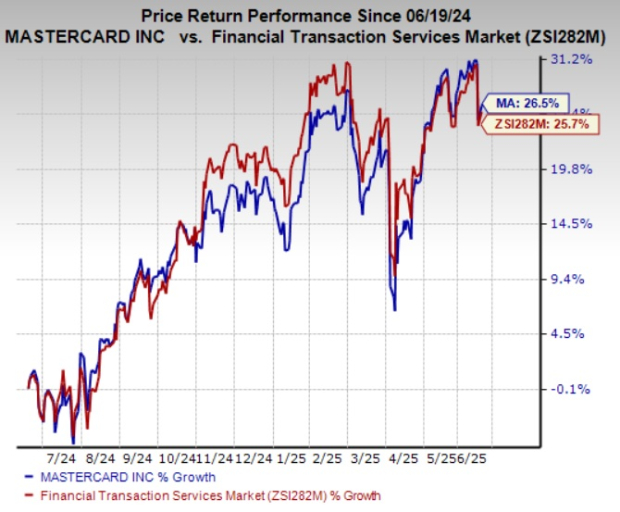

In comparison, Mastercard’s competitors, Visa Inc. (V) and PayPal Holdings, Inc. (PYPL), continue to enhance their payment solutions portfolios. Additionally, Mastercard’s shares have gained 26.5% in the past year, outpacing the industry’s growth of 25.7%. The company has seen upward revisions in earnings estimates, with projections for 2025 rising by 0.6% to $15.98 per share.