“`html

Coinbase Global, Inc. (COIN) shares rose 16.3% to $295.29 in the last trading session, driven by strong trading volume. This follows a 2.9% decline over the past month. The increase is attributed to the recent Senate approval of a stablecoin bill, which aligns with Coinbase’s strategy to scale its subscription services and make USDC the leading dollar-backed stablecoin globally.

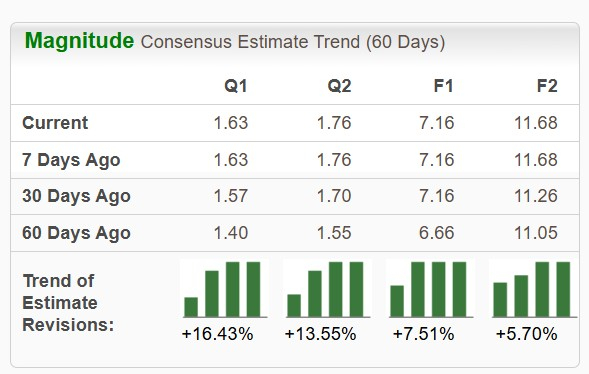

Coinbase is expected to report quarterly earnings of $0.91 per share, reflecting a 15% year-over-year decrease, while revenues are projected at $1.54 billion, up 6.3% from the previous year. Notably, the company’s EPS estimate has been revised 10% higher in the last 30 days, which could positively influence stock price movements.

As the largest registered crypto exchange in the U.S., Coinbase aims to leverage increased market volatility to improve its service offerings and future growth strategies.

“`