**Dycom Industries, Inc. (DY) is projected to continue strong performance through fiscal 2027, bolstered by an $8.22 billion backlog and a 25.1% year-over-year increase in adjusted EBITDA to $575.3 million for the first nine months of fiscal 2026.** The adjusted EBITDA margin expanded 140 basis points to 14.1%. The company emphasizes selective bidding to manage labor and equipment cost pressures while responding to strong public infrastructure funding and the opportunities presented by the Broadband Equity, Access and Deployment (BEAD) program.

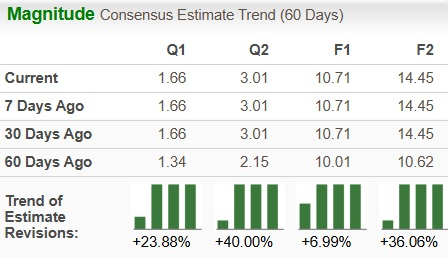

**Earnings estimates for DY indicate projected growth of 26.9% for fiscal 2026 and 35% for fiscal 2027, reflecting favorable market fundamentals and strategic planning.** The stock has risen 33.6% over the past six months, surpassing industry and market performance benchmarks. Currently, DY trades at a forward 12-month price-to-earnings ratio of 23.76, indicating a premium compared to industry peers.

**As a major player in the U.S. fiber and digital infrastructure growth cycle, Dycom stands out among competitors like EMCOR Group, Inc. and Quanta Services, Inc., specifically benefiting from BEAD funding initiatives.**