Globus Medical Shows Strong Earnings Potential: A Stock to Watch

Are you on the lookout for a stock that consistently exceeds earnings estimates? Consider Globus Medical (GMED), a notable player in the Zacks Medical – Instruments sector, which has shown a robust performance in its recent financial reports.

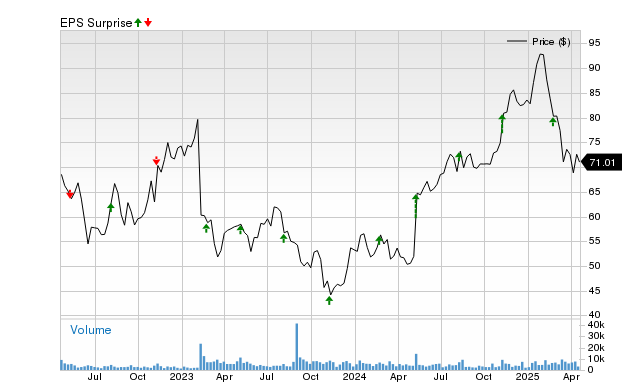

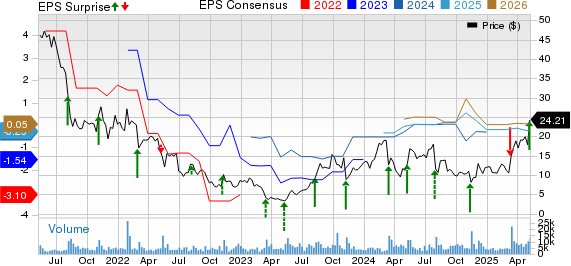

Recent Earnings Performance

This medical device company has established a notable pattern of surpassing earnings expectations, particularly in its last two quarterly reports, achieving an average surprise of 19.11%.

In the most recent quarter, Globus Medical was anticipated to earn $0.76 per share. However, it exceeded expectations with a report of $0.84 per share, resulting in a positive surprise of 10.53%. The prior quarter also saw a favorable outcome, with an actual earnings report of $0.83 per share compared to the expected $0.65, marking a significant surprise of 27.69%.

Analyzing Price and EPS Surprise

Globus Medical has had its earnings estimates raised, thanks to its impressive history of surprises. The stock’s current Zacks Earnings ESP (Expected Surprise Prediction) suggests a promising outlook for its upcoming earnings report. This indicator, when coupled with a solid Zacks Rank, could signify another potential earnings beat.

Stocks that present a combination of a positive Earnings ESP and a Zacks Rank of #3 (Hold) or higher tend to deliver a positive earnings surprise approximately 70% of the time. This means that out of 10 stocks with this profile, seven could potentially surpass the consensus estimate.

The Zacks Earnings ESP measures the Most Accurate Estimate against the Zacks Consensus Estimate for the quarter. This method assesses the accuracy of predictions that are updated by analysts shortly before an earnings release. These updates can provide insights that are more aligned with recent company performance.

Currently, Globus Medical holds an Earnings ESP of +2.40%, indicating a growing optimism among analysts regarding its near-term earnings capabilities. Together with its Zacks Rank #3, this adds to the likelihood of another earnings beat.

Understanding Earnings ESP

A negative Earnings ESP, while less predictive in nature, does not inherently indicate a future earnings miss. Many companies still outperform consensus EPS estimates, and a stock can maintain stability even when it falls short.

Given this landscape, it is essential for investors to evaluate a company’s Earnings ESP ahead of quarterly releases to enhance the chances of positive outcomes. Utilizing the Earnings ESP Filter can help pinpoint stocks worth considering before their earnings reports.

Market Insights: Zacks Identifies Top Semiconductor Stock

Alongside Globus Medical, Zacks has identified a leading semiconductor stock that now stands at just 1/9,000th the size of NVIDIA, which has surged over 800% since its recommendation. While NVIDIA remains a strong contender, the highlighted chip stock offers significant growth opportunities.

With robust earnings growth and an expanding customer base, this semiconductor company is well-positioned to capitalize on the soaring demand for Artificial Intelligence, Machine Learning, and the Internet of Things. Market projections indicate that global semiconductor manufacturing will expand from $452 billion in 2021 to $803 billion by 2028.

See This Semiconductor Stock Now for Free >>

Globus Medical, Inc. (GMED): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.