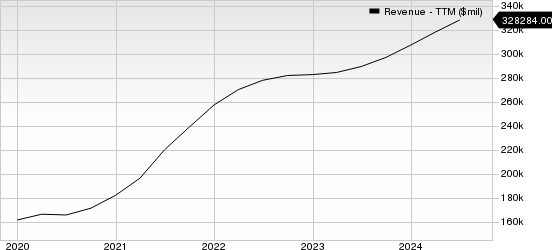

Alphabet’s Third-Quarter Earnings Preview: Strong Growth in Cloud Services Expected

Alphabet is set to release its third-quarter 2024 results on October 29, with predictions pointing towards growth driven by its expanding cloud services.

Cloud Computing: A Driving Force for Alphabet

Google Cloud has emerged as a significant driver of Alphabet’s revenue growth. The division encompasses Google Cloud Platform and Google Workspace, both of which are thriving in the rapidly expanding cloud computing market. Key investments in infrastructure, security, data management, analytics, and generative AI (Gen AI) have fueled this growth.

In the second quarter of 2024, Google Cloud revenues surged 28.8% year over year to $10.35 billion, representing 12.2% of Alphabet’s total revenue for that quarter.

Expected Revenue Growth for Google Cloud

According to the Zacks Consensus Estimate, Google Cloud revenues for the third quarter of 2024 are projected to reach $10.91 billion, reflecting a 29.8% increase compared to the prior year’s quarter.

Key Considerations for GOOGL’s Q3 Earnings

Alphabet’s integration of data lakes, warehouses, and advanced machine learning tools into its cloud platform is anticipated to enhance its market position. The company’s robust cloud service portfolio, alongside a growing network of data centers and availability zones, is expected to boost Google Cloud revenues significantly.

Real-time data analytics and AI capabilities have likely attracted new customers. The emphasis on generative AI, particularly with the momentum from its Gemini platform, is expected to add further strength to its third-quarter results.

The launch of Gemini Code Assist, designed for enterprise AI coding support, is also likely to benefit Google’s performance in the upcoming quarter.

Furthermore, the Vertex AI platform’s success and the introduction of new open-source tools, such as MaxDiffusion and JetStream, highlight Google’s continued investment in generative AI. These tools support various AI projects and infrastructure, enhancing its offerings and customer appeal.

Strong Partnerships to Support Q3 Performance

Alphabet’s diverse network of partnerships plays a crucial role in its cloud success. Companies like Workday and Cintas have extended collaborations with Google Cloud this quarter. Workday utilizes Google Cloud’s Gemini models and Vertex AI to streamline AI-powered processes.

Cintas is also leveraging Google Cloud technologies to develop a generative AI knowledge center, aimed at accelerating its digital transformation efforts.

Currently, Alphabet holds a Zacks Rank of #2 (Buy), indicating strong investor sentiment.

A $1 Opportunity to Access Zacks Recommendations

Take advantage of this unique offer.

Years ago, Zacks surprised its members with a chance to access all investment picks for just $1 for 30 days, with no additional commitments required. Thousands have capitalized on this opportunity, while others hesitated, thinking it too good to be true.

The motivation behind this offer is simple: Zacks wants users to familiarize themselves with their portfolio services, including Surprise Trader, Stocks Under $10, Technology Innovators, and more, which collectively achieved over 228 positions with double- and triple-digit gains in 2023.

To obtain recent stock analysis and investment reports from Zacks Investment Research, including insights on NVIDIA Corporation (NVDA), Cintas Corporation (CTAS), Workday, Inc. (WDAY), and Alphabet Inc. (GOOGL), visit their website today.

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.