Howmet Aerospace Inc. (HWM) reported an adjusted EBITDA margin of 28.8% for the first quarter of 2025, marking a 480 basis point increase from the previous year. This rise in margin follows consistent growth from 25.7% in Q2 2024 to 26.5% in Q3 2024 and 26.8% in Q4 2024. The company credits pricing strength and productivity gains amidst strong demand in the commercial and defense aerospace markets, particularly from the F-35 program.

For the year 2024, Howmet’s cost of goods sold rose by 7.3% year-over-year; however, it remained flat in Q1 2025. SG&A expenses also slightly decreased during the same quarter, contributing to improved profit margins while margins among peers varied, with RTX Corporation’s adjusted operating margin at 13.1% and GE Aerospace’s at 23.8% for Q1 2025.

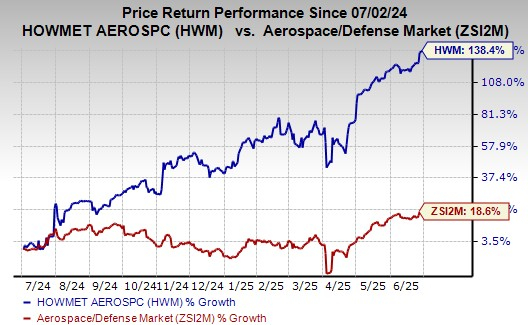

Howmet’s stock has surged 138.4% over the past year, outpacing the industry’s growth of 18.6%. Currently trading at a forward price-to-earnings ratio of 49.13, higher than the industry average of 26.77, Howmet continues to show strong operational efficiency and growth potential.