Meta Platforms Gears Up for Strong Q4 Earnings Report

Meta Platforms‘ META fourth-quarter 2024 results, set to be reported on Jan. 29, are expected to reflect the benefits of higher advertising revenues.

Find the latest EPS estimates and surprises on Zacks Earnings Calendar.

The Zacks Consensus Estimate for Meta Platforms’ fourth-quarter advertising revenues is pegged at $45.43 billion, indicating growth of 17.4% year over year.

Despite challenges related to AI monetization and regulatory issues, especially in Europe, strong advertising revenues are expected to bolster META shares following the earnings release.

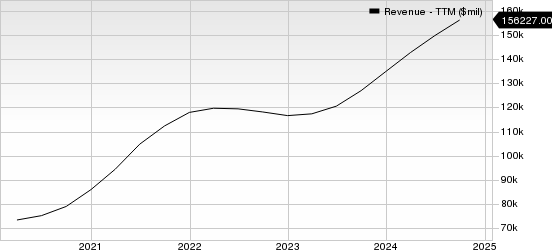

Meta Platforms, Inc. Revenue (TTM)

Meta Platforms, Inc. revenue-ttm | Meta Platforms, Inc. Quote

Click here to learn how Meta Platforms’ overall fourth-quarter performance is likely to be.

META’s Q4 Earnings Estimates Signal Improvement

The Zacks Consensus Estimate for META’s fourth-quarter earnings stands at $6.90 per share, which marks a 2.07% rise over the past month and indicates a 29.46% increase year-over-year.

In recent quarters, Meta Platforms has consistently outperformed the Zacks Consensus Estimate, with an average surprise of 11.34% over the last four announcements.

The current consensus estimate for fourth-quarter revenues is $46.97 billion, reflecting a 17.09% increase from the same quarter last year.

Ad Revenue Growth Supports META’s Q4 Projections

Meta’s vast reach and a 7% year-over-year increase in ad impressions during the third quarter of 2024 position it as a major player in the digital advertising world, along with Alphabet.

By enhancing ad rankings and measurement through artificial intelligence, Meta has fostered a strong return on investment for advertisers.

The Zacks Consensus Estimate for advertising revenues in Asia-Pacific is forecasted at $8.87 billion, indicating growth of 21.2% in Q4 2024. Similarly, estimates in various regions stand as follows: Europe at $10.791 billion (up 17.8%), the United States and Canada at $20.845 billion (up 17.2%), and the Rest of the World at $5.317 billion (up 19.5%).

AI and machine learning are enhancing user engagement on platforms like WhatsApp, Instagram, Facebook, and Threads, where AI-driven recommendations have played a critical role.

Moreover, Meta is focused on user safety and well-being by introducing features to improve parental control, messaging privacy, and time management, which likely contributed to user growth in the fourth quarter of 2024.

The Family Daily Active People (DAP), pegged at 3.33 billion for Q4 2024, is defined as users who logged into at least one Family platform each day.

Insights from Our Earnings Model

According to the Zacks model, a positive Earnings ESP combined with a Zacks Rank of #1 (Strong Buy), #2 (Buy), or #3 (Hold) bolsters the likelihood of surpassing earnings expectations. META fits this criterion with an Earnings ESP of +6.74% and a Zacks Rank #3.

Stocks to Watch

Consider these companies, which also show potential for positive earnings surprises based on our model:

BILL Holdings (BILL) has an Earnings ESP of +29.71% and a Zacks Rank #1. Over the last year, its shares rose 16.2%. BILL will report its fiscal Q2 2025 results on Feb. 6.

ServiceNow (NOW) currently holds an Earnings ESP of +0.91% and a Zacks Rank of 2. It has seen a 45.1% increase in share value over the past year and will report its Q4 2024 results on Jan. 29.

DoorDash (DASH) has an Earnings ESP of +35.67% and a Zacks Rank of 2 as well. Its shares have jumped 65.2% in the past year, with Q4 2024 results scheduled for Feb. 11.

5 Stocks Poised for Significant Growth

These stocks have been selected by Zacks experts as having the potential to gain +100% or more in 2024. While not all selections may succeed, previous recommendations have achieved remarkable increases of +143.0%, +175.9%, +498.3%, and +673.0%.

Many of these stocks are currently overlooked by Wall Street, presenting a prime opportunity to invest early.

Curious about more recommendations from Zacks Investment Research? Download the free report on 7 Best Stocks for the Next 30 Days.

ServiceNow, Inc. (NOW) : Free Stock Analysis Report

BILL Holdings, Inc. (BILL) : Free Stock Analysis Report

DoorDash, Inc. (DASH) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.