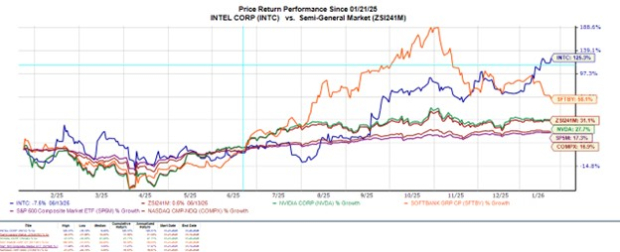

Intel (INTC) is experiencing a significant turnaround, with its stock reaching a two-year high of $50, up from a low of $17 last April. This resurgence comes ahead of its Q4 earnings report on January 22, which is expected to show a 6% decline in sales to approximately $13.38 billion and a drop in earnings per share (EPS) to $0.08. Historically, Intel has exceeded expectations, boasting an average sales surprise of 4.69% and a remarkable earnings surprise of 577% over the past year.

Key drivers behind Intel’s recovery include substantial investments from the U.S. government and partnerships with companies like Nvidia and SoftBank. Analysts have upgraded their ratings for Intel, with Seaport Research raising their price target to $65 due to improvements in product momentum and manufacturing capabilities. Intel’s Panther Lake PC platform and its 18A chip manufacturing process are seen as pivotal in reviving its competitiveness and attracting external clients, including potential deals with Apple.

Despite its recent stock gains, analysts caution that better buying opportunities may arise unless Intel demonstrates outstanding Q4 results. Currently, the stock has a Zacks Rank of #3 (Hold), amid speculation about whether to buy into its recent rally.