“`html

President Trump signed a new tax bill on July 4, increasing tax credits for semiconductor firms from 25% to 35%. This legislation, named the ‘One Big Beautiful Bill’, aims to support companies like Intel Corporation (INTC) in expanding their manufacturing processes before the 2026 deadline. The initiative builds on the 2022 CHIPS and Science Act, which allocated $39 billion in grants and up to $75 billion in loans for manufacturing projects.

Intel has received $7.86 billion in direct funding under the CHIPS and Science Act to further semiconductor manufacturing initiatives across Arizona, New Mexico, Ohio, and Oregon. The company is focusing on its IDM 2.0 strategy and optimizing its production processes while considering to prioritize 14A over third-party production to enhance competitiveness.

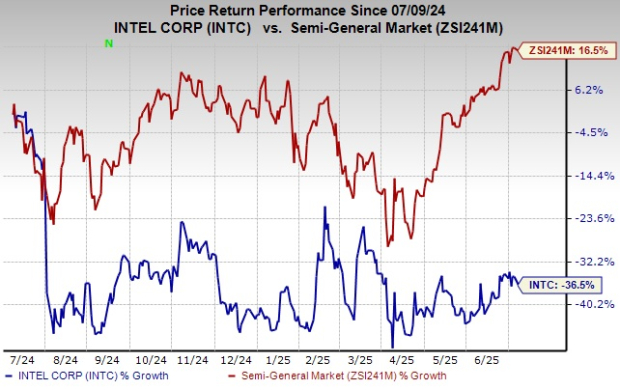

Other semiconductor companies, including NVIDIA Corporation (NVDA) and Advanced Micro Devices, Inc. (AMD), are expected to benefit from the new funding aimed at advancing AI infrastructure and domestic manufacturing for AI-enabled devices. Intel shares have declined by 36.5% over the past year, contrasting with a 16.5% growth in the industry.

“`