Intel Advances AI Workloads with Xeon 6 Processors Amid Challenges

Intel Corporation (INTC) captured considerable attention at the Mobile World Congress (MWC) in Barcelona, Spain, showcasing its newly launched Xeon 6 processors featuring Performance-cores (P-Cores). Designed to meet the soaring demand for high AI workloads across various sectors, this system-on-chip (SoC) offers leading performance in data center tasks and boasts up to two times the performance in AI processing. The Xeon 6 family positions itself as the top option for AI central processing units (CPUs) while ensuring a lower total cost of ownership (TCO).

Technical Advancements of the Xeon 6 Processors

Built on the x86 computer architecture, the Intel Xeon 6700/6500 series processors are engineered with high core counts and integrated acceleration to cater to multiple market segments. They deliver an average performance boost of 1.4 times compared to previous generations. With an effective 5:1 consolidation rate of five-year-old servers, Xeon 6 processors enhance performance-per-watt efficiency, leading to as much as 68% reduction in TCO. This new generation effectively balances performance and energy efficiency.

The Intel Xeon 6 processors, tailored for network and edge platforms, utilize Intel’s built-in accelerators for virtualized radio access networks (vRAN), media processing, AI, and network security. This capacity meets the increasing demand for robust network solutions in an AI-centric landscape, achieving up to 2.4 times the RAN capacity along with a 70% improvement in performance-per-watt compared to earlier versions, thanks to Intel vRAN Boost.

Commitment to AI Chips with 5N4Y Strategy

Intel is progressing with its 5N4Y initiative (five nodes in four years) to reclaim leadership in transistor and power performance by 2025. The Xeon 6 processor with Efficient-cores (E-cores), also known as Sierra Forest, marks a significant step as Intel’s first Intel 3 server product designed for high-density, scale-out workloads.

Reportedly, Intel Xeon platforms have set benchmarks in the 5G cloud-native core sector, demonstrating notable improvements in performance and power efficiency. These enhancements have attracted substantial interest from major telecom equipment manufacturers and independent software vendors aiming to optimize power savings for a sustainable future.

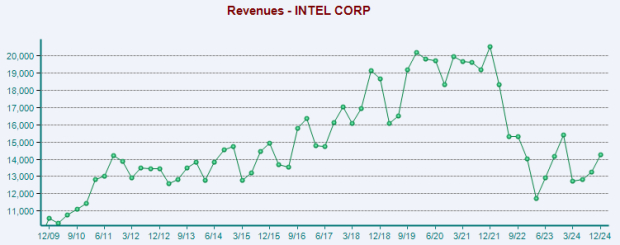

Intel’s traction in the AI PC sector continues to grow, with projections to ship over 100 million units by the end of 2025. The Panther Lake chip, based on Intel 18A and the successor to the well-received Lunar Lake, is expected to launch in the latter half of 2025. Clearwater Forest, the first Intel 18A server product, is anticipated to debut in the first half of 2026. Furthermore, Intel has released the Core Ultra, featuring a neural processing unit to enable efficient AI acceleration, showcasing 2.5 times better power efficiency than its previous iteration. The new vPro platform with the Intel Core Ultra enhances power efficacy and AI capabilities across applications. Despite these innovations leading to a revenue uptrend in recent quarters, figures remain significantly lower than last year.

Image Source: Zacks Investment Research

Stock Price Performance and Market Position

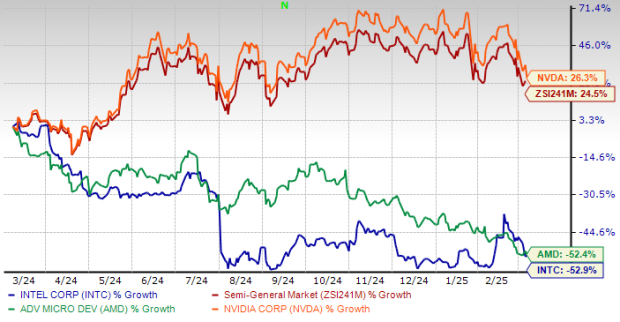

Over the past year, Intel’s stock has plunged 52.9%, contrasting sharply with the industry’s growth of 24.5%. The company’s performance has lagged behind rivals Advanced Micro Devices, Inc. (AMD) and NVIDIA Corporation (NVDA). This decline results from substantial financial and operational difficulties, prompting management to conduct a complete review and implement restructuring at senior levels.

Image Source: Zacks Investment Research

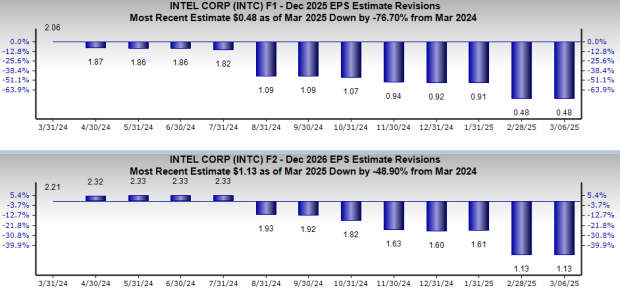

Estimate Revision Trends for Intel

Earnings estimates for Intel in 2024 have dropped by 106.5% to a projected loss of 9 cents, while estimates for 2025 have decreased by 55.6% to 92 cents. These negative revisions reflect bearish sentiments regarding the stock.

Image Source: Zacks Investment Research

Challenges Ahead for Intel

Recent product launches might be perceived as “too little too late” for Intel. Although the company has expanded its footprint in AI, it finds itself trailing NVIDIA’s innovations, particularly with the popularity of the H100 and Blackwell GPUs. Major tech companies are reportedly acquiring NVIDIA’s GPUs to build computing clusters for AI, resulting in significant revenue growth for NVIDIA.

Additionally, the accelerated production of AI PCs has pressured Intel’s short-term margins. Moving production to a high-capacity facility in Ireland, where wafer costs are typically higher, has also affected profitability. Furthermore, increased charges related to non-core businesses, penalties for unused production capacity, and an unfavorable product mix have strained margins.

Impact of US-China Trade Relations on Intel

In 2024, China accounted for over 29% of Intel’s revenues, making it its largest market. However, recent attempts by China to replace U.S.-made chips with domestic alternatives have negatively impacted Intel’s revenue outlook. The directive to eliminate foreign chips from critical telecom networks by 2027 underscores China’s drive for technological self-sufficiency amid rising tensions with the U.S.

President Trump has previously imposed a 10% tariff on imports from China, increasing to a total of 20%. As the U.S. tightens restrictions on high-tech exports, China’s push for self-reliance in key industries continues to challenge Intel, creating potential market restrictions alongside intensified competition from domestic chipmakers. Weaker spending in both consumer and enterprise markets, particularly in China, has resulted in elevated inventory levels, softening demand trends. Furthermore, stringent export controls are likely to further impact market dynamics, hampering revenue growth in the immediate future.

Conclusion

Intel is navigating a challenging landscape as it grapples with rising competition and market dynamics influenced by external factors.

Intel Faces Tough Competition Amidst Industry Challenges

Intel Corporation (INTC) is currently grappling with increasing competitive pressures in the semiconductor industry. The price-sensitive market is seeing significant competition for customer retention, a trend that is expected to intensify in the near future. This aggressive competition could hinder Intel’s capability to attract and maintain a solid customer base, which may adversely affect its operational and financial performance.

Challenges Ahead for Intel

The future for Intel appears challenging, laden with various obstacles. How the company addresses these challenges in the coming months will be critical. Intel currently holds a Zacks Rank of #3 (Hold), indicating a cautious stance on its stock performance. For those interested, a complete list of today’s Zacks #1 Rank (Strong Buy) stocks is available here.

Just Released: Zacks Top 10 Stocks for 2025

Investors have a chance to get in early on Zacks Director of Research Sheraz Mian’s top selections for 2025. This portfolio, featuring ten exceptional stocks, has shown impressive performance, with gains of +2,112.6% from its inception in 2012 through November 2024. This significantly surpasses the S&P 500’s +475.6% during the same period. Mian has meticulously analyzed 4,400 companies covered by the Zacks Rank to identify the top 10 picks for buying and holding in 2025. Don’t miss the opportunity to see these newly released stocks with substantial potential.

Want the latest recommendations from Zacks Investment Research? You can download the 7 Best Stocks for the Next 30 Days today. Click here to access this free report.

Detailed stock analyses for key companies are also available:

- Intel Corporation (INTC) : Free Stock Analysis report

- Advanced Micro Devices, Inc. (AMD) : Free Stock Analysis report

- NVIDIA Corporation (NVDA) : Free Stock Analysis report

This article was originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.