Tesla Faces Criticism Amid Leadership Challenges and Sales Decline

Tesla (NASDAQ: TSLA) shareholders have experienced significant volatility recently. The company’s chief executive, Elon Musk, has been a focal point in the news, primarily for events unrelated to Tesla. Through his leadership in the new Department of Government Efficiency (DOGE), Musk aims to target what he and the Trump Administration identify as waste within the federal bureaucracy.

This involvement in government has rendered Musk a polarizing figure. Concurrently, Tesla’s stock price has plummeted approximately 40% since its peak in December, as the company encounters difficulties in increasing sales. Nevertheless, Tesla remains a profitable electric vehicle (EV) manufacturer and leads in autonomous driving and robotics, with a swiftly expanding energy storage sector. These factors foster a sense of cautious optimism for investors.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

Despite Challenges, Tesla Remains a Leading Auto Manufacturer

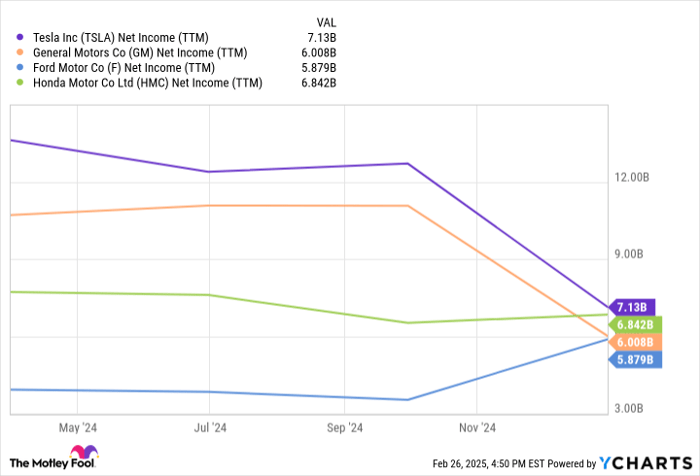

Importantly, Tesla, despite its youth and recent difficulties, ranks among the ten most profitable car manufacturers globally. Its net income is comparable to established brands like Honda, General Motors, and Ford, as shown in the chart below.

TSLA Net Income (TTM) data by YCharts.

Presently, much of the discourse about Tesla centers on its future potential. This is understandable given its development of impressive technologies. However, the bulk of its revenue is still derived from vehicle sales. Out of the $97.69 billion in total sales reported last year, over $77 billion stemmed from its EVs.

This reality magnifies concerns regarding its declining car sales, as Tesla—which is typically classified as a growth stock—has demonstrated underwhelming sales growth of less than 4% in four of the past five quarters.

Sales Struggle in Europe

Conditions may be worsening. Influenced by Musk’s contentious involvement in European politics, particularly in Germany and Britain, Tesla’s sales in Europe have recently plummeted. Although overall EV sales in Europe surged by 37% year over year in January, Tesla’s sales decreased by an alarming 45%. This stark contrast highlights a troubling trend.

Public sentiment towards Musk has soured; a significant 73% of Germans deem his political entanglements “unacceptable.” Furthermore, Tesla now faces heightened competition from both traditional automotive giants and newcomers like China’s BYD Co., which has recently outpaced Tesla in sales within the U.K.

Valuation Insights

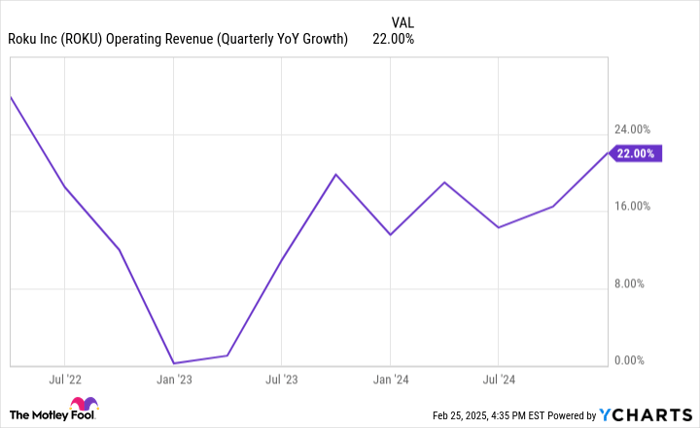

While many futuristic avenues may transform Tesla’s business, such as a global “robotaxi” service powered by its autonomous technology, most revenue remains tied to car sales. Comparing Tesla’s valuation to those of typical automakers is not entirely appropriate; however, it is important to recognize that growth projections are largely speculative. The next chart illustrates the market’s optimistic betting on a transformation that has not yet occurred.

TSLA PE Ratio data by YCharts.

Concerns About Future Growth

At this juncture, I express severe concerns about Tesla. It appears that a significant portion of the stock’s value is based on hype, allowing investors to overlook slow sales growth and declining profit margins. With a price-to-earnings (P/E) ratio of 142, Tesla’s valuation seems exorbitantly high for an automaker, especially compared to Nvidia, which, with its stronghold in the AI chip market, has a P/E of 52.

Consequently, I cannot endorse Tesla as a worthy investment at this time. While Musk’s ambitious vision may come to fruition, I do not currently view Tesla as a millionaire-maker.

A New Investment Opportunity Awaits

Many investors feel they missed their chance to buy into successful stocks. Our expert analysts have issued a rare “Double Down” alert for companies they believe are poised for substantial growth. Now is the ideal time to invest before potential opportunities slip away. Here are a few examples:

- Nvidia: If you invested $1,000 when we issued our double down in 2009, you’d have $311,551!*

- Apple: If you invested $1,000 when we doubled down in 2008, you’d have $44,990!*

- Netflix: If you invested $1,000 when we doubled down in 2004, you’d have $519,375!*

Our team is now offering “Double Down” alerts for three remarkable companies, presenting an opportunity that may not come around again soon.

Continue »

*Stock Advisor returns as of February 28, 2025

Johnny Rice does not hold positions in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia and Tesla and recommends BYD Company and General Motors. The Motley Fool adheres to a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.