Analyzing Tesla: Millionaire Potential or Risky Investment?

Without a doubt, Tesla (NASDAQ: TSLA) remains one of the most compelling stocks available. Opinions differ widely on the company; some view it as a troubled brand with an outdated vehicle lineup facing the threat of being labeled vastly overvalued. Others see it as a technology leader poised to revolutionize the market with its future robotaxi service. Here’s the lowdown.

Path to a Million-Dollar Investment

First, let’s break down some numbers illustrating how Tesla might pave the way for millionaire status. Assuming Ark Invest’s price target of $2,600 for Tesla Stock in 2029 becomes a reality, you would need to hold 385 Tesla shares to reach a valuation of $1 million. At current prices, purchasing these shares would set an investor back nearly $105,000.

Start Your Mornings Smarter! Get Breakfast News delivered to your inbox every market day. Sign Up For Free »

Considering the substantial initial investment required, Tesla Stock may not be the best option for most retail investors aspiring to achieve millionaire status. Nonetheless, the potential for significant returns remains.

Understanding Tesla’s Valuation

I mention Ark’s valuation model to illustrate differing perceptions of Tesla Stock. For proponents like Ark, Tesla’s valuation leans heavily on its anticipated robotaxi offerings, which the model implies represent 88% of the company’s total value, while electric vehicles account for only 9%.

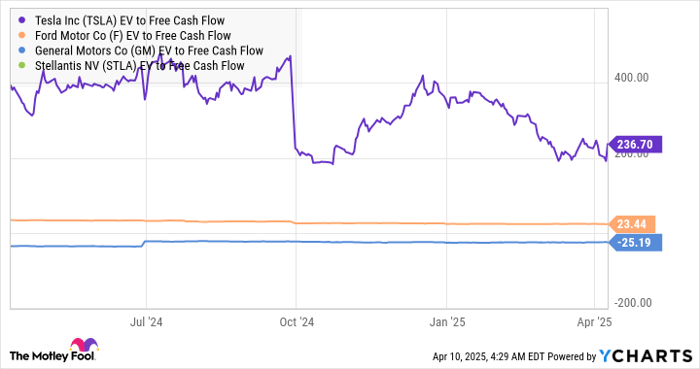

This perspective helps clarify why Tesla commands exceptionally high valuations compared to traditional automakers. Although notable for its success in the electric vehicle market, the true value of Tesla Stock is believed to reside in future revenue generated from robotaxi profit-sharing. Under Ark’s model, about $2,288 of the share price stems from robotaxis, whereas only $234 relates to Tesla’s EV business.

TSLA EV to Free Cash Flow data by YCharts.

Supporting the Bullish Case for Tesla

For the bullish scenario to materialize, investors must accept several assumptions:

- Tesla will roll out its robotaxi service (potentially including its Cybercab) as promised. CEO Elon Musk believes it will launch “unsupervised full self-driving as a paid service in Austin by June.”

- The company will begin volume production of its purpose-built robotaxi, the Cybercab, soon, with management asserting that production will start in 2026.

- Rapid adoption, overcoming regulatory obstacles, and addressing safety concerns are essential.

- Tesla can produce an affordable Cybercab, leading to lower ride costs compared to competitors like Waymo and traditional taxi services.

Reasons Tesla Could Achieve These Goals

There is reason for optimism among investors. Despite high interest rates affecting EV production plans, Tesla has continued to invest, reducing its vehicle production cost to less than $35,000 by the end of 2024, down from over $38,000 in early 2023. This reduction is crucial for encouraging EV adoption, as the Cybercab also needs to be affordable, and management plans to introduce a “more affordable” model in the first half of 2025.

Image source: Getty Images.

In contrast, consider Ford, which told investors in 2016 it would produce driverless cars by 2021, yet reported a $5.1 billion loss in its EV division in 2024.

Additionally, Tesla retains its leadership in the EV space, which is advantageous for its robotaxi plans. This leadership results in a vast, continuously updated dataset from its Autopilot and Full-Service Driving (FSD) technology, which can help lower costs per ride and enhance its FSD capabilities.

Though sales declines in 2025 have garnered significant media scrutiny, Tesla captured more than 44% of U.S. EV sales in Q4 2024. This strong market presence and brand recognition create a favorable environment for robotaxi success.

The Risks Involved with Tesla Stock

Despite positive indicators, numerous uncertainties remain. Most of the value attributed to the Stock is tied to technology that is not yet operational. Historically, Tesla has faced challenges with meeting timelines for unsupervised FSD and the rollout of robotaxis/Cybercab. Questions linger regarding the Austin launch, the potential involvement of the Cybercab, the target production timeline starting in 2026, and whether the anticipated “more affordable” model is imminent. Additionally, the escalating tariff conflicts with China could adversely affect Tesla’s cost structure, particularly since the company sources batteries and components from there.

Image source: Getty Images.

Is Tesla a Millionaire-Maker Stock?

The potential rewards associated with Tesla are substantial, but so are the risks. Thus, Tesla Stock is mainly suited for enterprising, speculative investors or those willing to take a smaller position in a stock with significant upside possibilities.

For most investors, Tesla’s path to profitability and its robotaxi goals require numerous favorable conditions to materialize. Its high share price makes it unlikely to serve as a millionaire maker for average retail investors hoping for low entry costs. Still, it may attract those with diversified portfolios who can effectively manage risk.

Don’t Miss This Second Chance for Potential Gains

Ever feel like you missed out on the opportunity to invest in top-performing stocks? You’ll want to pay attention to this.

Occasionally, our expert analysts issue a “Double Down” Stock recommendation for companies poised for rapid growth. If you’re concerned you’ve missed your investment window, now may be the right time to purchase before prices rise. The statistics are compelling:

- Nvidia: If you invested $1,000 when we doubled down in 2009, you’d have $287,670!*

- Apple: If you invested $1,000 when we doubled down in 2008, you’d have $37,568!*

- Netflix: If you invested $1,000 when we doubled down in 2004, you’d have $495,226!*

Currently, we are issuing “Double Down” alerts for three exceptional companies, available when you join Stock Advisor, and opportunities like this may not arise again soon.

View the 3 stocks »

*Stock Advisor returns as of April 10, 2025

Lee Samaha has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Tesla. The Motley Fool recommends General Motors and Stellantis. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.