Keysight Technologies, Inc. KEYS has been entrusted by UL Solutions to serve as the certification test partner for Thunderbolt 5 products, solidifying UL Solutions’ standing as an Intel-authorized lab for Thunderbolt 5 technologies.

Thunderbolt 5 certification requires adherence to rigorous standards, a challenge accepted by Keysight alongside UL Solutions in their joint effort to ensure product compliance. Utilizing a range of Keysight test and measurement equipment, such as the Infiniium UXR B Series Oscilloscopes, the M8000 Series High-Performance BERT and ENA Vector Network Analyzers, the certification process aims to verify Thunderbolt 5 compliance.

Introducing Thunderbolt 5 signifies a substantial leap in wired connectivity, achieving data transfer speeds up to 120 Gbps — nearly three times faster than its predecessor, Thunderbolt 4. This advancement allows for seamless integration of cutting-edge display technologies, enhanced power delivery, and accelerated transfers of data-heavy files like ultra-high-definition videos and intricate 3D models, ultimately optimizing workflow efficiency, productivity, and user experience.

Keysight’s Testing Solutions Gain Industry Recognition

Keysight’s prominence is on the rise due to the increasing demand for its electronic design and testing solutions. As electronic devices play a pivotal role in IoT services, wireless technology, data centers, and 5G advancements, the swift uptake of these devices fuels the need for Keysight’s electronic testing apparatus.

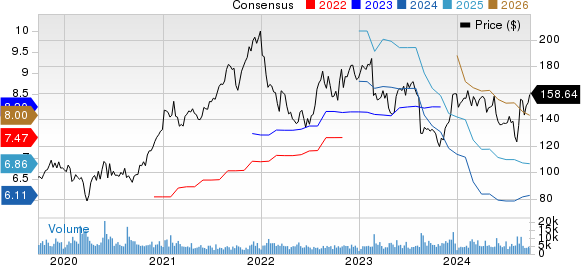

KEYS’ Zacks Rank & Stock Performance

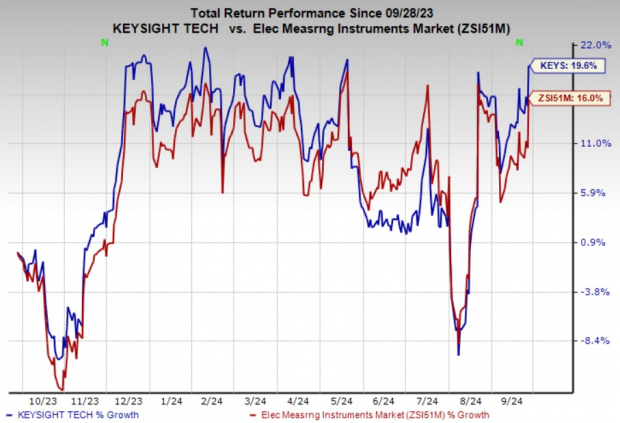

KEYS currently holds a Zacks Rank #3 (Hold). The company’s shares have surged by 19.6% over the past year, surpassing the sub-industry’s growth of 16%.

Image Source: Zacks Investment Research

Stocks Worthy of Consideration

Within the broader technology sector, some noteworthy stocks include Seagate Technology Holdings plc STX, ANSYS, Inc. ANSS, and American Software, Inc. AMSWA. STX currently holds a Zacks Rank #1 (Strong Buy), while ANSS & AMSWA boast a Zacks Rank #2 (Buy).

Seagate Technology has delivered an average earnings surprise of 80.9% in three of the last four quarters, achieving a remarkable earnings surprise of 40% in the most recent quarter. The Zacks Consensus Earnings Estimate for STX has experienced an 18% increase to $7.41 over the past 60 days.

ANSYS, with an average earnings surprise of 4.8% in three of the trailing four quarters, demonstrated a significant earnings surprise of 28.9% in the last reported quarter. The company also maintains a long-term earnings growth expectation of 6.4%.

American Software has an impressive track record of delivering an average earnings surprise of 84.5% in the last four quarters, including a substantial earnings surprise of 71.4% in the most recent quarter. The Zacks Consensus Earnings Estimate for AMSWA has risen by 8.6% to 38 cents in the last 60 days.

To read this article on Zacks.com click here.

Market News and Data brought to you by Benzinga APIs