Methanex Positioned for Strong Earnings Beat in Upcoming Report

For investors seeking stocks with a consistent record of surpassing earnings estimates, Methanex (MEOH) presents a compelling option. Operating within the Zacks Chemical – Diversified industry, Methanex is well-positioned to continue its earnings momentum in the upcoming quarterly report.

This methanol supplier has demonstrated a remarkable trend of exceeding earnings expectations, particularly highlighted by its performance over the last two quarters, achieving an average surprise of 98.89%.

Earnings Performance Overview

In its last reported quarter, Methanex reported earnings of $1.24 per share, significantly outpacing the Zacks Consensus Estimate of $1.01 per share with a surprise of 22.77%. Previously, the company was estimated to achieve earnings of $0.44 per share, yet it delivered an impressive $1.21 per share, resulting in a remarkable surprise of 175%.

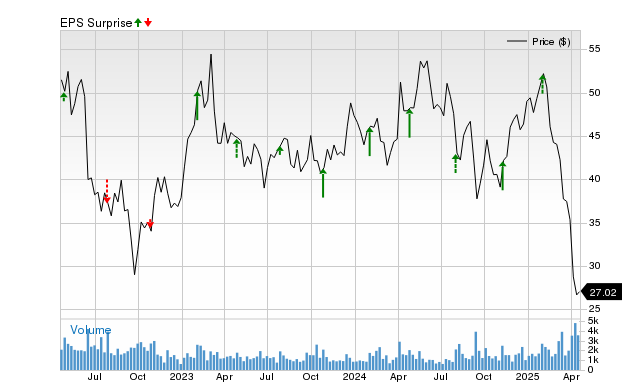

Price and EPS Surprise Analysis

Estimates for Methanex have been trending upward, bolstered by its recent earnings surprise history. The stock currently boasts a positive Zacks earnings ESP (Expected Surprise Prediction), which is a strong indicator of potential for future earnings beats. When this is coupled with its solid Zacks Rank, it heightens the likelihood of exceeding expectations.

Research indicates that stocks with a positive earnings ESP and a Zacks Rank of #3 (Hold) or higher have nearly a 70% chance of producing a positive surprise. This means, of a select group of ten stocks with these characteristics, as many as seven might surpass consensus estimates.

The Zacks earnings ESP assesses the Most Accurate Estimate against the Zacks Consensus Estimate for the quarter. The Most Accurate Estimate is derived from analysts who have recently revised their expectations, thus potentially offering a more precise forecast compared to those who contributed to the earlier consensus.

Currently, Methanex has an earnings ESP of +4.74%, indicating that analysts are optimistic about the company’s earnings prospects. This favorable earnings ESP and the stock’s Zacks Rank of #3 (Hold) suggest that another earnings beat could be imminent. The upcoming earnings report is scheduled for April 30, 2025.

Investors should be aware that a negative earnings ESP does not necessarily signal an impending earnings miss; however, it can diminish the predictive strength of this metric.

Many companies do manage to outperform the consensus EPS estimate, but that is not the sole factor for a stock’s price increase. Additionally, some stocks may maintain stability even when they fall short of estimates.

For this reason, assessing a company’s earnings ESP prior to its quarterly release is vital to enhancing success rates. Investors should utilize our earnings ESP Filter to discover the most promising stocks to buy or sell before earnings announcements.

Zacks Identifies Top Semiconductor Stock

A recent highlight involves a semiconductor stock that is just 1/9,000th the size of NVIDIA, which has surged over +800% since our recommendation. While NVIDIA remains a strong performer, this new top chip stock holds greater potential for growth.

With robust earnings growth and an expanding customer base, it’s strategically positioned to meet the soaring demand for Artificial Intelligence, Machine Learning, and the Internet of Things. Global semiconductor manufacturing is forecasted to soar from $452 billion in 2021 to $803 billion by 2028.

View This Stock Now for Free >>

For the latest insights from Zacks Investment Research, you can download “7 Best Stocks for the Next 30 Days.” Click to obtain this free report.

Methanex Corporation (MEOH): Free Stock Analysis report.

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.