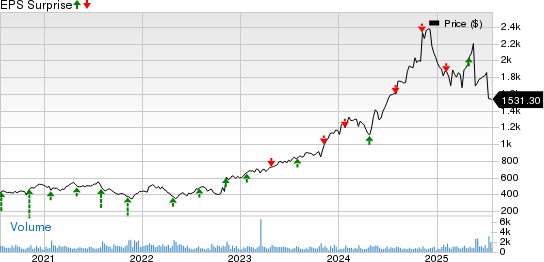

Palantir Stock Surges 9% After Government Contract Expansions

Palantir PLTR stock rose as much as 9% on Friday, driven by its expansion in government contracts. This follows a significant increase in investor sentiment, with shares skyrocketing over 1,300% in the past three years.

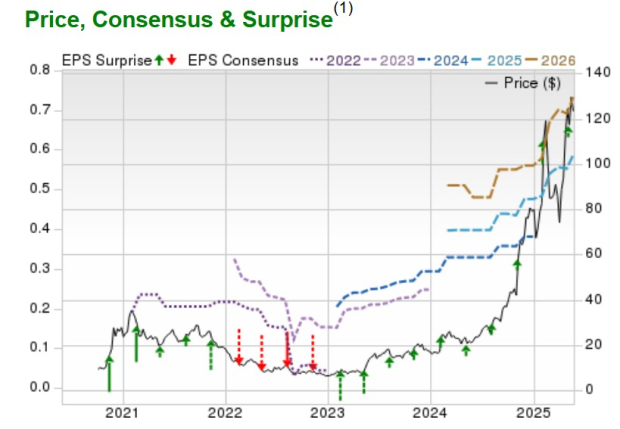

Post-rally, Palantir approached its 52-week and all-time high of $133 per share, raising questions about the potential for further gains in PLTR.

Image Source: Zacks Investment Research

Government Contract Expansion

According to the New York Times, President Trump has enlisted Palantir to manage personal data for federal agencies including the Department of Homeland Security (DHS) and the Internal Revenue Service (IRS). This project aims to streamline data sharing and improve collaboration among agencies, particularly in counterterrorism efforts.

In addition, Palantir has partnered with Fannie Mae FNMA to fight mortgage fraud and secured a $795 million modification to an existing contract with the U.S. Army, raising its total value to $1.3 billion. The partnership will establish an AI-powered Crime Detection Unit, while the Army deal extends licenses for its Maven Smart System (MSS), designed to enhance military operations through advanced data analytics.

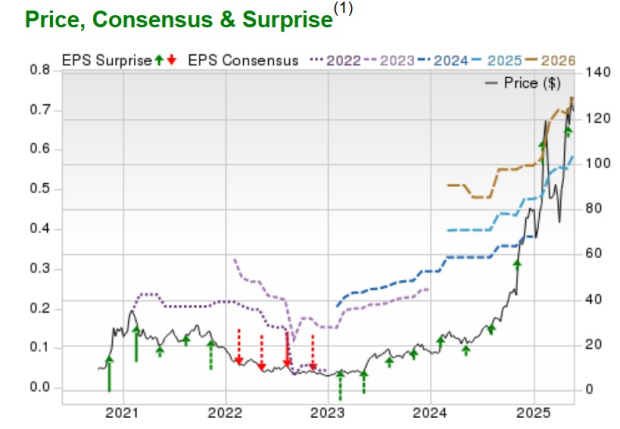

Palantir’s Growth Projections

Zacks forecasts Palantir’s total sales will grow by 37% this year to $3.92 billion, up from $2.87 billion in 2024. Sales are expected to climb another 28% in fiscal 2026 to $5.02 billion. Furthermore, annual earnings are projected to rise 44% in FY25 and 24% in FY26, reaching $0.73 per share.

Recent revisions for earnings estimates are also positive, with Palantir’s FY25 and FY26 EPS estimates increasing by 7% and 6%, respectively, over the past month.

Image Source: Zacks Investment Research

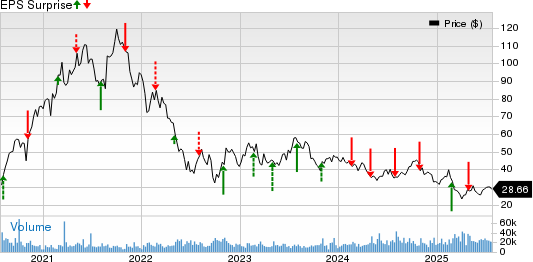

Valuation Metrics

Despite profitability, Palantir trades at a high forward earnings multiple of 208.3X. Although the company has moved beyond a speculative phase, it maintains a stretched price-to-sales ratio of 92.6X compared to the Zacks Internet-Software Industry average of 4X and the S&P 500’s 4.9X.

The company’s PEG ratio stands at 5.9, which is higher than the industry average and the S&P 500’s 1.7, indicating valuation concerns as a PEG below 1 is generally preferred.

Image Source: Zacks Investment Research

Momentum Assessment

Palantir holds a “B” Momentum score after a notable gain of over 50% in the past three months, finishing May up 10%. The signing of new contracts may contribute to continued momentum in its stock price.

Image Source: Zacks Investment Research

Conclusion and Outlook

Palantir currently embodies a “C” VGM grade for Value, Growth, and Momentum under the Zacks Style Scores framework, which complements the Zacks Rank. Presently, it holds a #3 (Hold) Zacks Rank.

While potential high gains exist, the sharp rally limits compelling earnings estimate revisions, particularly given the company’s current valuation. However, the recent contract signings could lead analysts to adjust their price targets positively, potentially sustaining the stock’s rise.