Progress Software Enhances Sitefinity with AI Innovations

Progress Software (PRGS) has introduced AI-driven enhancements to its Sitefinity content management platform, aiming to speed up content creation and improve digital customer interaction.

New Features in Sitefinity 15.3

The latest Sitefinity 15.3 version integrates embedded Generative AI (Gen AI) services that help marketers summarize content, personalize communications, and generate relevant tags within the system. Additionally, PRGS has introduced AI-enhanced media search, enabling users to find visuals using natural language. Built-in Azure AI translation facilitates efficient multilingual content management.

Moreover, Sitefinity now supports in-line AI-based content optimization and advanced business intelligence system integration. This empowers organizations to streamline workflows, enhance digital assets, and utilize custom AI models for more profound insights and improved marketing effectiveness.

Financial Updates and Market Performance

PRGS’ Strong Portfolio Boosts Prospects

Despite a year-to-date decline of 11.8% in PRGS shares, this performance is slightly better than the broader Zacks Computer & Technology sector, which has dropped 14.5%. Notably, following the announcement of first-quarter fiscal 2025 earnings results on March 31, Progress Software’s shares increased by 11.5%.

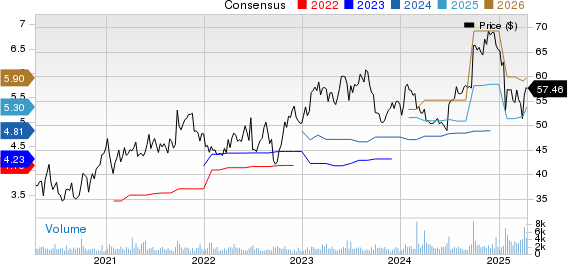

Quantitative Analysis: Price and Consensus

Progress Software Corporation price-consensus-chart | Progress Software Corporation Quote

In the fiscal first quarter, annualized recurring revenues (ARR) reached $836 million, marking a 48% increase year over year when accounted for constant currency. This growth was bolstered by robust performance in ShareFile and steady contributions from core products like OpenEdge, Sitefinity, DevTools, Kemp LoadMaster, and WhatsUp Gold.

For the reported quarter, revenues amounted to $238 million, aligning with guidance and reflecting a 29% year-over-year rise.

Strategic Focus on AI Integration

AI remains central to Progress Software’s strategy, with ongoing efforts to embed AI functionalities across its offerings. This month, the company announced tailored AI enhancements in ShareFile aimed at boosting efficiency and ensuring data security, thereby improving existing document-centric workflows.

Competitive Landscape in AI Deployment

AI Arms Race: PRGS Faces Stiff Competition

The AI initiatives at Progress Software align with broader trends in the industry, where competitors are rapidly expanding their AI capabilities.

PRGS has outperformed competitors enhancing their AI adoption speeds, such as Oracle (ORCL) and Adobe (ADBE). Year-to-date, Oracle’s shares have dipped 19.5%, while Adobe’s have significantly declined by 21.3%.

Oracle has recently deepened its partnership with NVIDIA to fast-track AI deployment. By natively integrating NVIDIA AI Enterprise software and NIM microservices into Oracle Cloud Infrastructure (OCI), users can leverage over 160 AI tools and deploy advanced reasoning models like Llama Nemotron directly from the OCI Console. This positions Oracle as a comprehensive AI provider, offering scalable infrastructure ideal for enterprise-level AI tasks.

Meanwhile, Adobe collaborates with Microsoft (MSFT) to enhance AI accessibility via Microsoft 365 Copilot. At the recent Adobe Summit 2025, they launched a preview of Adobe Marketing Agent and Adobe Express Agent, integrating AI-driven tools into Microsoft Teams, PowerPoint, and Word. These tools help marketers pinpoint target audiences using Adobe Experience Platform and create impactful visual content through Adobe Express, along with automating performance reporting.

While smaller than its competitors, Progress Software’s AI integration strategy reflects a focus on optimizing user experiences, promoting automation, and simplifying content workflows.

Positive Financial Outlook for Q2 2025

PRGS Offers Positive Guidance for Q2 2025

For the upcoming second quarter of fiscal 2025, PRGS estimates revenues between $235 million and $241 million. The Zacks Consensus Estimate for revenues is currently $237.85 million, projecting a 35.85% growth compared to the same quarter last year.

Non-GAAP earnings per share are forecasted to range from $1.28 to $1.34. The consensus estimate for earnings is set at $1.31 per share, anticipating a 20.18% increase year over year.

Looking ahead to fiscal 2025, PRGS expects revenues between $958 million and $970 million. The Zacks Consensus Estimate for fiscal 2025 revenues stands at $965 million, indicating a projected 28.08% increase from the previous fiscal year’s actual results.

Non-GAAP earnings per share are anticipated to fall between $5.25 and $5.37. The estimate for earnings is pegged at $5.3 per share, implying a year-over-year growth of 7.51%.

Zacks Rank Overview

Zacks Rank

Currently, PRGS holds a Zacks Rank #3 (Hold). For a complete list of today’s Zacks #1 Rank (Strong Buy) stocks, click here.

Investment Recommendations

7 Best Stocks for the Next 30 Days

Just released: Experts have identified 7 elite stocks among the current list of 220 Zacks Rank #1 Strong Buys, which they believe are “Most Likely for Early Price Pops.”

Since 1988, the total list has outperformed the market more than 2X, achieving an average annual gain of +23.9%. It’s advisable to pay close attention to these seven stocks.

For the latest recommendations from Zacks Investment Research, you can download the report on the 7 Best Stocks for the Next 30 Days. Click to access this free report.

Microsoft Corporation (MSFT): Free Stock Analysis Report

Oracle Corporation (ORCL): Free Stock Analysis Report

Adobe Inc. (ADBE): Free Stock Analysis Report

Progress Software Corporation (PRGS): Free Stock Analysis Report

This article was originally published by Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.