Exploring Recursion Pharmaceuticals: A Potential Giant in AI-Driven Biotech

Successfully navigating the stock market requires patience and a long-term outlook. The key is to stick to a consistent plan and make regular contributions to a retirement account, allowing the power of compounding to work its magic over time. However, the search for potential multibagger stocks, particularly those with disruptive innovations, remains captivating. The prospect of investing in companies that could yield significant returns on investment draws many investors’ attention.

Start Your Mornings Smarter! Wake up with Breakfast News in your inbox every market day. Sign Up For Free »

Recursion Pharmaceuticals: A Leader in AI Biotechnology

Recursion Pharmaceuticals (NASDAQ: RXRX) stands out as a clinical-stage biotech company harnessing artificial intelligence (AI) for drug discovery. This innovative approach aims to revolutionize medicine and attract attention from investors eager for growth. Let’s explore whether investing in this stock could position you for future wealth.

The Power of AI in Drug Discovery

Recursion has quickly become a frontrunner in AI-enabled biotechnology. It boasts the BioHive-2 supercomputer, backed by Nvidia AI chips, which ranks as one of the most powerful accelerated computing systems globally.

Through advanced machine learning techniques, BioHive-2 processes vast amounts of biological data to find drug targets, including proteins and genes linked to diseases. Recursion’s operating system analyzes millions of compounds to identify potential drug candidates while predicting key properties to improve drug design.

This efficiency accelerates research into treatments across a variety of conditions and cuts costs compared to traditional methods.

This year, Recursion merged with Exscientia, another AI-focused biotech. By combining Exscientia’s advanced chemical design capabilities with Recursion’s biology-driven methods, they have created a more robust operation.

Image source: Getty Images.

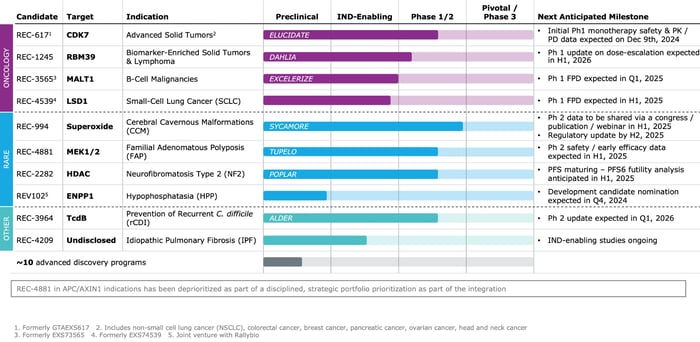

A Look at Recursion’s Drug Pipeline

Recursion’s technology has already shown promising outcomes, leading to a strong pipeline that also includes Exscientia’s legacy programs. One standout candidate is REC-994, potentially the first oral treatment for symptomatic cerebral cavernous malformation (CCM), a serious brain condition lacking approved therapies.

Another promising candidate, REC-617, has shown positive results in a recent phase 1 interim study focused on advanced solid tumors. The company believes this drug has “best in class” potential, further enhancing Recursion’s appeal to investors.

Eyes will be on Recursion in 2025 as clinical readouts and regulatory updates may act as catalysts for the stock:

Source: Recursion Pharmaceuticals.

Considerations for Investors

At least one of Recursion’s candidates is expected to gain approval, potentially transforming the company into a commercially viable entity within the next decade. However, predicting a massive return on investment is a tougher proposition, as it would require the company to create a blockbuster drug that could generate billions in sales over several years.

Currently, Recursion faces significant challenges. It generates limited revenue from partnership milestone payments and grants while incurring high operating expenses. Analysts expect continued financial losses, projecting negative earnings per share (EPS) will worsen from a forecasted loss of $1.54 this year to $1.65 by 2025.

| Metric | 2023 | 2024 (Estimate) | 2025 (Estimate) |

| Revenue (in millions) | $44.6 | $70.0 | $76.0 |

| Revenue change (YOY) | 12% | 57% | 9% |

| Earnings per share (EPS) | ($1.58) | ($1.54) | ($1.65) |

| EPS change (YOY) | N/A | N/A | N/A |

Data source: Yahoo Finance. YOY = year over year.

While long-term growth prospects might make the market overlook Recursion’s lack of profitability, this could put pressure on the stock. Currently, shares are down about 55% from their 52-week high, and any regulatory setbacks could lead to even bigger losses.

Moreover, the competitive landscape is fierce. Large biotech and pharmaceutical companies such as Merck, AstraZeneca, and Pfizer are increasingly integrating AI into their research and development processes. This raises questions about Recursion’s ability to maintain a competitive edge.

Concluding Thoughts

While Recursion Pharmaceuticals carries intriguing possibilities, investing now may be premature without clearer insights into its product approvals. As 2025 approaches, it will be critical for the company to outline its long-term potential, making it worth watching.

Your Opportunity for Investment Insight

Ever feel like you overlooked the chance to buy the next big stocks? Here’s your chance to stay informed.

Occasionally, our expert analysts issue a “Double Down” stock recommendation for companies they predict will spike in value soon. If you believe you’ve missed prior investment opportunities, consider this your time to act:

- Nvidia: If you invested $1,000 when we doubled down in 2009, you’d have $349,279!*

- Apple: If you invested $1,000 when we doubled down in 2008, you’d have $48,196!*

- Netflix: If you invested $1,000 when we doubled down in 2004, you’d have $490,243!*

We are currently alerting investors to three exceptional “Double Down” stocks, with limited-time opportunities for growth.

See 3 “Double Down” stocks »

*Stock Advisor returns as of December 16, 2024

Dan Victor has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Merck and Pfizer. The Motley Fool recommends AstraZeneca Plc. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.