Rivian Automotive (NASDAQ: RIVN) aims to become a leading player in the electric vehicle (EV) market, presenting significant growth potential for investors. The company plans to produce three new models — the R2, R3, and R3X — expected to retail under $50,000, contrasting with its current luxury models priced above $70,000. As a step toward achieving profitability, Rivian is projected to reach 57,000 vehicle productions this year, forecasting a “modest gross profit” by Q4 2024 after reducing current losses of about $32,000 per vehicle.

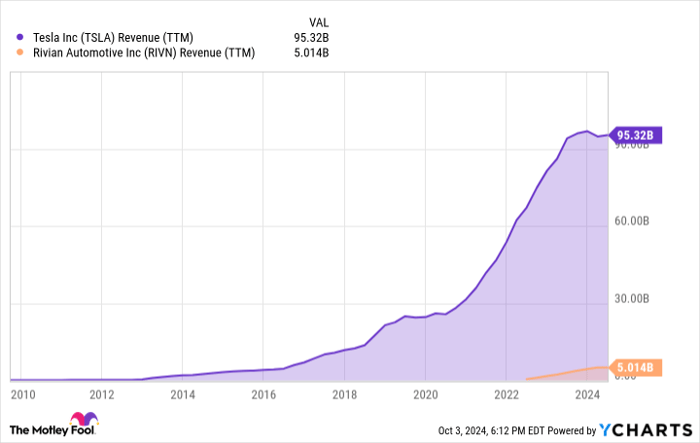

The company’s current market capitalization stands at approximately $11 billion, with a potential to generate $30 billion in annual revenue by 2030, suggesting a valuation close to $60 billion. Currently, Rivian’s price-to-sales ratio is around 1.9, compared to Tesla’s historical 5 times sales ratio, indicating room for valuation increases if it successfully executes its growth strategy.

Despite a 90% decline in stock value since its IPO in 2021, analysts suggest that the current market price offers a good entry point for investors, urging patience as Rivian navigates its growth journey.