Roblox: Analyzing Its Market Position and Future Potential

Roblox (NYSE: RBLX) emerged as a notable player in the gaming sector following its direct listing on March 10, 2021. Initially, the stock opened at $64.50 and soared to an all-time high of $134.72 on November 19, 2021. Investors responded positively to its rapid expansion and strong appeal among younger users.

As of now, however, Roblox’s stock hovers around $70. With the recent slowdown in its pandemic-driven growth and a series of losses, the company faces ongoing challenges including regulatory concerns. The question remains: Can Roblox regain momentum and yield substantial returns over the next decade?

Roblox’s Niche Market Expansion

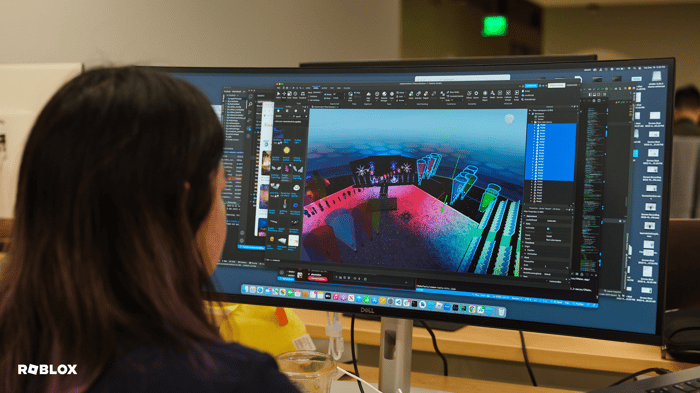

Roblox empowers users to create games with an intuitive drag-and-drop interface, requiring no coding expertise. Its marketplace provides pre-made assets that enhance the experience, while advanced users can utilize Lua, a scripting language, for added features.

Creators on Roblox can earn through an in-game currency called Robux, fueling a cycle that attracts more players and boosts Robux purchases.

The platform gained immense traction during the pandemic, as many tweens spent extended periods online. Additionally, Roblox is developing an advertising system, with brands creating virtual “metaverse” spaces within its platform.

However, growth metrics such as bookings, daily active users (DAUs), and average bookings per daily active user (ABPDAU) experienced deceleration in 2022. Critics suggest Roblox may not retain its appeal as its youthful audience matures.

|

Metric |

2021 |

2022 |

2023 |

2024 |

|---|---|---|---|---|

|

Bookings Growth |

45% |

5% |

23% |

24% |

|

DAU Growth |

40% |

23% |

22% |

21% |

|

ABPDAU Growth |

4% |

(14%) |

0% |

2% |

|

Hours Engaged Growth |

35% |

19% |

22% |

23% |

Data source: Roblox.

Despite prior deceleration, growth re-accelerated in 2023 and 2024 as Roblox expanded its reach internationally and attracted an older demographic. Although new DAUs tend to generate lower bookings than its traditional tween audience, user engagement remains strong, which could bolster future Robux sales and overall growth.

In the first quarter of 2025, Roblox’s bookings increased by 31% year over year, with DAUs growing by 26% to 97.8 million. Average bookings per DAU rose by 4%, and total engagement hours surged by 30% to 21.7 billion. This uptick suggests the platform may remain sustainable, countering bearish projections.

For the full year, Roblox anticipates bookings growth of 21% to 23%, accompanied by an adjusted EBITDA increase of 14% to 47%. Nonetheless, the company is currently unprofitable on a GAAP basis and continues to invest heavily in safety measures for its young audience, manage its developer exchange fees, and enhance cloud systems.

Future Gains: A Possibility for Roblox?

Roblox, with a current market capitalization of $47.78 billion, trades at approximately nine times this year’s bookings. While considered not a bargain, this ratio could be justified if the company sustains double-digit growth in bookings.

Analysts predict a compound annual growth rate (CAGR) of 20% for bookings from 2024 to 2027. If Roblox maintains this growth trajectory into the next decade, annual bookings could reach $32.25 billion by 2035. At a continued valuation of nine times its forward bookings, the market cap could potentially expand to $290.25 billion over ten years.

This scenario could transform a $10,000 investment into over $60,000. However, substantial gains may require purchasing more shares, and the company may face ongoing challenges in balancing user safety costs with growth objectives.

As such, while Roblox might present an attractive opportunity for patient investors, the likelihood of substantial gains within the decade remains uncertain. Its established niche allows for growth, but the company must ensure its platform’s safety and validate its business model for long-term expansion.

Is Investing $1,000 in Roblox a Smart Move?

Prior to making a $1,000 investment in Roblox, consider the current market landscape:

Recent analyst evaluations have suggested alternative stocks with potentially higher short-term returns. Investors should contemplate broader options as they navigate this evolving marketplace.

Please note that the accuracy of investment returns is subject to risks and market shifts.

Leo Sun has no position in any of the stocks mentioned. This analysis reflects personal evaluations and does not represent the views of any affiliated institutions.

The views and opinions expressed herein are those of the author and may not reflect those of Nasdaq, Inc.