“`html

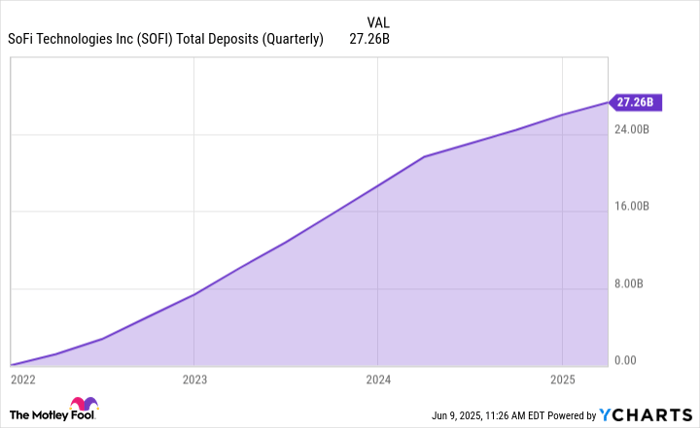

SoFi Technologies (NASDAQ: SOFI) has reported impressive growth, achieving $2.67 billion in total revenue for the past year, which marks a 26% increase year-over-year. Its deposit base has also grown by 39% to $25.9 billion. Furthermore, the company reached GAAP profitability for the first time with earnings per share (EPS) of $0.39, exceeding estimates.

SoFi, which originally focused on student loan refinancing, diversified its offerings to include personal loans, banking, and investment services after acquiring Golden Pacific Bancorp in 2022, allowing it to accept deposits. The fintech company is underpinned by strong demand for its products and has secured substantial lending commitments, including a recently expanded $5 billion agreement with Fortress Investment Group.

Analysts predict an additional 23% revenue growth this year as SoFi continues to expand its customer base and enhance its technology platforms. Last quarter, SoFi reported revenue of $771 million, a 33% increase compared to the previous year, raising interest in its stocks among potential investors.

“`