“`html

Tutor Perini Corporation (TPC) reported $2 billion in new awards and contract adjustments in Q1 2025, leading to a record-high backlog of $19.4 billion as of March 31, 2025—up 94% year-over-year. This growth is attributed to strong demand for construction services across various sectors, including healthcare, education, and hospitality, driven by governmental infrastructure investments.

Additionally, Tutor Perini has raised its 2025 earnings guidance, anticipating strong demand to continue throughout the year, with over $500 million in new awards already secured in Q2. Comparatively, EMCOR Group, Inc. (EME) and Granite Construction Incorporated (GVA) are also poised for growth in this favorable market, reporting a total of $5.7 billion in committed projects for Granite in Q1 2025, reflecting a 3.6% year-over-year increase.

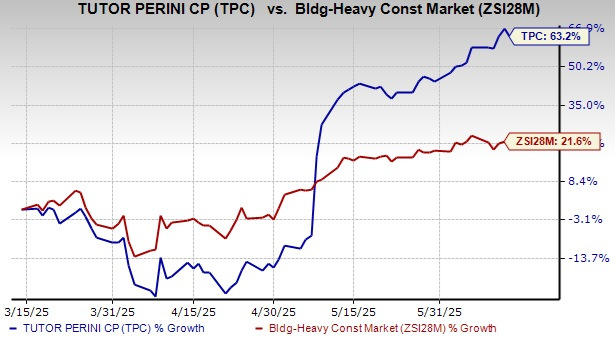

Tutor Perini’s stock has gained 63.2% in the past three months, significantly outperforming the Zacks Building Products – Heavy Construction industry, which grew by 21.6%. TPC’s forward price-to-earnings ratio stands at 18.55X, slightly below the industry’s 19.23X.

“`