“`html

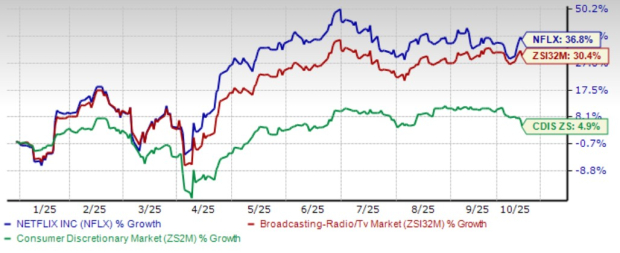

Netflix, Inc. (NFLX) has raised its full-year 2025 operating margin guidance to 30%, up from 29%, following a strong Q2 that saw a 700 basis points year-over-year expansion. This growth is attributed to an increase in premium and ad-tier subscribers and disciplined cost management. The company’s pricing strategy, which includes subscription plans ranging from $7.99 to $24.99 per month in key markets like the U.S. and Canada, remains a core profit driver.

Netflix’s advertising tier has seen substantial growth, now reaching 94 million monthly active users, with future ad revenues expected to double in 2025. The company has updated its 2025 revenue forecast to between $44.8 billion and $45.2 billion, reflecting a 15-16% increase year-over-year. The Zacks Consensus Estimate anticipates a 16% revenue growth for 2025 and 13% for 2026.

In comparison, Amazon and Warner Bros. Discovery are also enhancing their advertising strategies, with Amazon’s retail media revenues projected to surpass $60 billion in 2025 and WBD aiming for $1.3 billion in streaming profit by the same year.

“`