2024 Stock Market Highlights: SoundHound AI Surges Amid AI Boom

As 2024 comes to a close, the stock market has experienced remarkable growth, with the S&P 500 index reaching record highs an impressive 50 times. Factors contributing to this surge include a strong economy and predictions that the Federal Reserve will continue to lower interest rates. However, the major driving force appears to be excitement surrounding artificial intelligence (AI). While some investors worry the market is overextended, the AI sector continues to expand at a rapid pace.

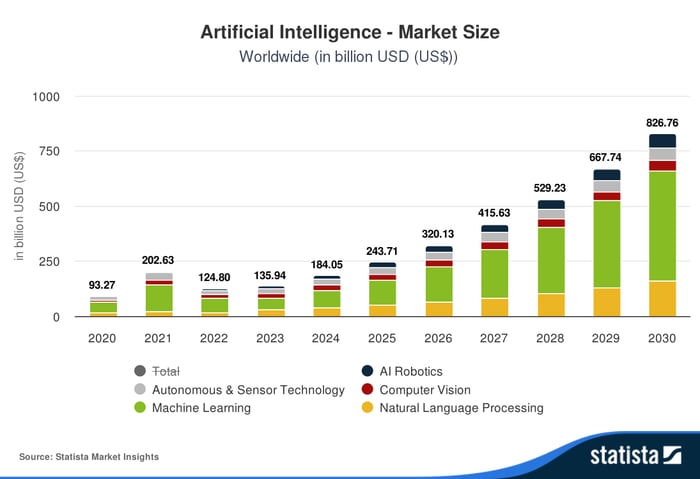

Chart by Statista.

The AI sector is projected to increase revenues fourfold by 2030, igniting competition among companies and investors eager for a share of this growth.

Exploring the Potential of SoundHound AI

AI offers numerous applications including voice recognition technology. This technology allows for conversational interaction and is already being utilized in various sectors. One of the leaders in this space, SoundHound AI (NASDAQ: SOUN), has seen its stock soar by 578% in 2024 alone.

What can we expect looking ahead to 2025?

SoundHound’s Expanding Market Opportunities

The potential financial benefits of conversational speech recognition are substantial. For instance, automating orders at drive-thrus can significantly reduce employee costs. Renowned companies like White Castle, Papa John’s, and Applebee’s are already testing SoundHound’s technology, with Torchy’s Tacos recently implementing it at their locations.

The automotive industry is another key market for SoundHound, allowing for queries such as, “What’s the most scenic route?” or “Where can I find Italian food nearby?” This marks a considerable shift from previous limited voice commands.

According to Statista, the voice recognition market is predicted to double by 2030, showcasing the impressive growth trajectory.

Chart by Statista.

SoundHound’s revenue is growing more rapidly than that of the overall market.

Evaluating SoundHound Stock: Is It Time to Buy?

In its third quarter, SoundHound announced a remarkable 89% increase in year-over-year revenue, totaling $25 million. The company now projects sales between $82 million and $85 million for 2024, with a potential $165 million in 2025. While revenue growth is promising, investors should be cautious as the company remains unprofitable and currently does not generate positive cash flow.

After witnessing a 171% increase over the past month, questions arise regarding SoundHound’s valuation. Currently trading at 33 times its expected 2025 sales of $165 million, the stock’s $5.5 billion market cap raises concerns, especially for a non-profitable company. Analysts have set an average price target for SoundHound at $8.07, significantly lower than its current price of $14.62. While I have been optimistic about SoundHound’s future, it may be wise for investors to wait for a correction before buying.

Should You Invest $1,000 in SoundHound AI Now?

Before making any investment in SoundHound AI, it’s important to consider some key points:

The Motley Fool Stock Advisor analyst team recently recommended their top 10 stocks for investors, and SoundHound AI did not make the list. The selected stocks have the potential to generate significant returns in the years to come.

Reflect on Nvidia, which was included on April 15, 2005; had you invested $1,000 then, you’d now have $872,947*.

Stock Advisor offers guidance for investors, including strategies for building a portfolio, regular updates, and two new stock picks each month—a service that has outpaced the S&P 500 by more than four times since 2002*.

See the 10 stocks »

*Stock Advisor returns as of December 2, 2024.

Bradley Guichard holds long position options on SoundHound AI. The Motley Fool has no position in any of the stocks mentioned. For more information, refer to The Motley Fool’s disclosure policy.

The views and opinions expressed here are those of the author and do not necessarily reflect those of Nasdaq, Inc.