Unlocking Wealth: The Case for the Vanguard Growth ETF

Beating the S&P 500 index is no small feat, yet many professional investors struggle to do so, often charging high fees. Surprisingly, achieving excellent investment results can stem from a straightforward approach. Even simple strategies can yield impressive outcomes.

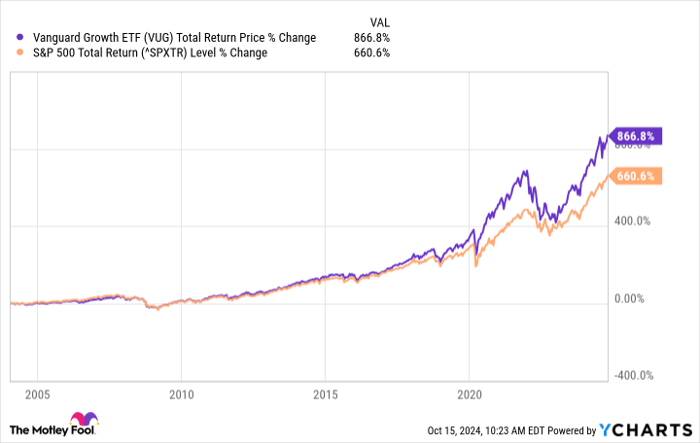

Consider the Vanguard Growth ETF (NYSEMKT: VUG). This unassuming index fund has consistently outperformed the S&P 500 since its inception!

The following sections reveal how this simple index fund can become a significant asset for wealth accumulation in any financial portfolio.

A Simple Strategy for Outperforming the S&P 500

You don’t have to be a genius at picking stocks to beat the S&P 500 index. Investing in the Vanguard Growth ETF and holding it has demonstrated solid results. Launched in 2004, this fund has developed a robust track record across various market conditions, including both bull and bear markets.

VUG Total Return Price data by YCharts

Let’s take a moment to understand what an index fund is. The Vanguard Growth ETF serves as an exchange-traded fund designed to imitate a stock market index. Indexes consist of groups of stocks that reflect the overall performance of the market or economy. Some indexes cover a vast range of stocks, while others focus on specific sectors.

You might know of popular indexes like the Dow Jones Industrial Average and the S&P 500. The Vanguard Growth ETF tracks the less-known CRSP US Large Cap Growth Index, which includes nearly 200 large-cap growth stocks (those with market caps over $10 billion).

By purchasing a single share of the Vanguard Growth ETF, investors gain exposure to all the companies within this index, making it an easy way to diversify your investments.

The Advantage of the Investment Strategy

What propels the Vanguard Growth ETF’s success is more about its investment strategy than the individual stocks within the fund.

In general, stocks can be classified into two categories: growth and value. Growth stocks are typically fast-growing companies focused on increasing revenue and market share, while value stocks are more mature, profitable firms that return cash to investors through dividends or buybacks.

Although growth stocks tend to be more volatile, they often yield superior long-term returns. The Vanguard Growth ETF invests heavily in high-growth sectors such as technology (58% of the fund) and consumer discretionary (18%), compared to the S&P 500, which allocates 32% to technology and 10% to consumer discretionary.

This difference creates a higher risk and volatility profile for the Vanguard Growth ETF, but it also offers greater potential upside—a trend that has been evident over time.

Positioning for Future Returns

Ultimately, the investment philosophy rather than specific stocks drives the performance of the Vanguard Growth ETF. Over time, stock market indexes, such as the CRSP US Large Cap Growth Index, will shift as new companies emerge and others decline. The outlook for growth stocks—especially in the technology realm—continues to be bright, moving from the digital age into cloud computing and, more recently, artificial intelligence (AI).

Major technology players like Apple, Microsoft, and Nvidia comprise a significant portion of the fund, positioning them well to capitalize on AI’s expansion.

However, it’s essential to note that growth stocks can be unpredictable. Often, they carry higher valuations, which means they may be vulnerable to significant drops during market downturns. Investors witnessed this reality in 2022, as rising interest rates shifted preference toward value stocks. Predicting market cycles is nearly impossible, so focusing on the long term and continuously investing new savings remains crucial.

If you adhere to this strategy, the Vanguard Growth ETF might help you amass considerable wealth over the next 20 to 30 years.

Should You Invest $1,000 in Vanguard Index Funds – Vanguard Growth ETF Now?

Before you decide to purchase shares in Vanguard Index Funds – Vanguard Growth ETF, here are some considerations:

The Motley Fool Stock Advisor analyst team has recently highlighted what they believe are the 10 best stocks to buy at present, and notably, Vanguard Index Funds – Vanguard Growth ETF is not included. The selected stocks are projected to deliver outstanding returns over the next few years.

For context, when Nvidia made this list on April 15, 2005, a $1,000 investment would now be worth $845,679!*

Stock Advisor offers investors a straightforward roadmap to success, including portfolio-building advice, analyst updates, and two new stock picks each month. Since 2002, the Stock Advisor service has more than quadrupled the returns of the S&P 500.*

See the 10 stocks »

*Stock Advisor returns as of October 14, 2024

Justin Pope does not hold any positions in the stocks mentioned. The Motley Fool has shares in and recommends Apple, Microsoft, Nvidia, and Vanguard Index Funds-Vanguard Growth ETF. For transparency, the Motley Fool recommends long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. Refer to the Motley Fool’s disclosure policy for more details.

The views and opinions expressed in this article reflect those of the author and do not necessarily represent the views of Nasdaq, Inc.