A Ray of Light in the European Solar Market

Canadian Solar Inc.’s subsidiary, Recurrent Energy, has added another feather to its cap with the successful acquisition of a solar photovoltaic portfolio south of Spain. This move marks a significant stride towards fulfilling the company’s ambitious plan to kickstart construction on over 1 gigawatt of solar projects in Spain by 2024.

Shining Through the Project Details

The recently acquired solar portfolio, nestled in Carmona, Seville, comprises four interconnected projects named Rey I, II, III, and IV. Equipped with Canadian Solar’s cutting-edge TopBiHiKu7 N-type bifacial Tunnel Oxide Passivated Contact modules, these projects boast a collective generation capacity exceeding 420 megawatt peak (MWp).

The Rey solar portfolio is projected to yield roughly 916 gigawatt-hours (GWh) of clean electricity annually, mitigating approximately 184,000 tons of carbon dioxide emissions. Lighting up the homes of 275,000 individuals in Carmona, these projects are beacons of sustainable energy.

Expanding Horizons in Europe

Across the globe, Europe has emerged as a torchbearer for renewable energy adoption, with a fervent push towards green technologies. Canadian Solar has been strategically fortifying its presence in Europe’s solar market, with the Europe, Middle East, and Africa region contributing a substantial 25% to its total revenues in 2023.

The recent acquisition underscores Canadian Solar’s commitment to expanding its footprint in the European solar landscape. By Jan 31, 2024, Recurrent Energy had amassed an impressive solar development project pipeline of 9,915 MWp in the EMEA region.

With SolarPower Europe projecting a 11% year-over-year growth in solar installations in Europe, the strategic moves by Canadian Solar are poised to propel the company to new heights in the region.

Rising with Peers

Not alone in their ascent, Canadian Solar is joined by companies like Enphase Energy, SolarEdge, and Emeren Group, all of which are making remarkable strides in Europe’s solar market:

Enphase Energy (ENPH) has been steadily expanding its presence in Europe, with an impressive 31% of total revenues originating from the region in 2023. The company’s long-term earnings growth rate of 17.3% speaks volumes about its potential.

Similarly, SolarEdge (SEDG) is making waves in Germany, the U.K., and Switzerland, with a substantial 64% of its 2023 revenues hailing from Europe. SolarEdge’s shares have soared by a remarkable 76.3% over the past five years.

Meanwhile, Emeren Group (SOL) has been an established player in Europe since 2012, with a commanding 68% of total revenues stemming from the region in the third quarter of 2023. The company’s robust growth trajectory is reflected in the Zacks Consensus Estimate projecting a 48.8% rise in sales for 2024.

Charting the Path Ahead

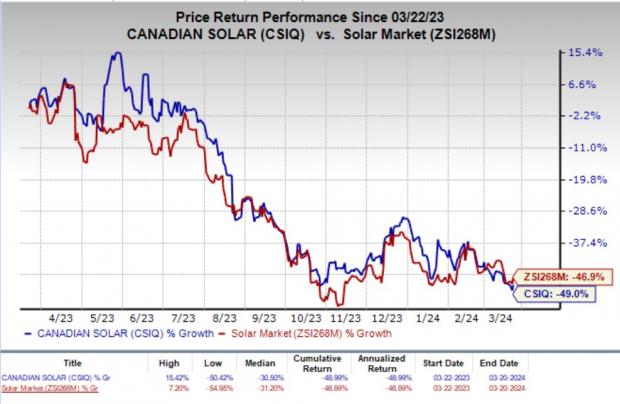

Despite a 49% dip in Canadian Solar’s shares over the past year, the company’s strategic acquisitions and adept maneuvering in the European solar market position it favorably for future growth, as depicted in its Zacks Rank #3 (Hold) designation.

As the solar industry in Europe glows with promise, Canadian Solar’s recent acquisition not only illuminates its path but also underscores its commitment to leading the charge towards a greener future.