“`html

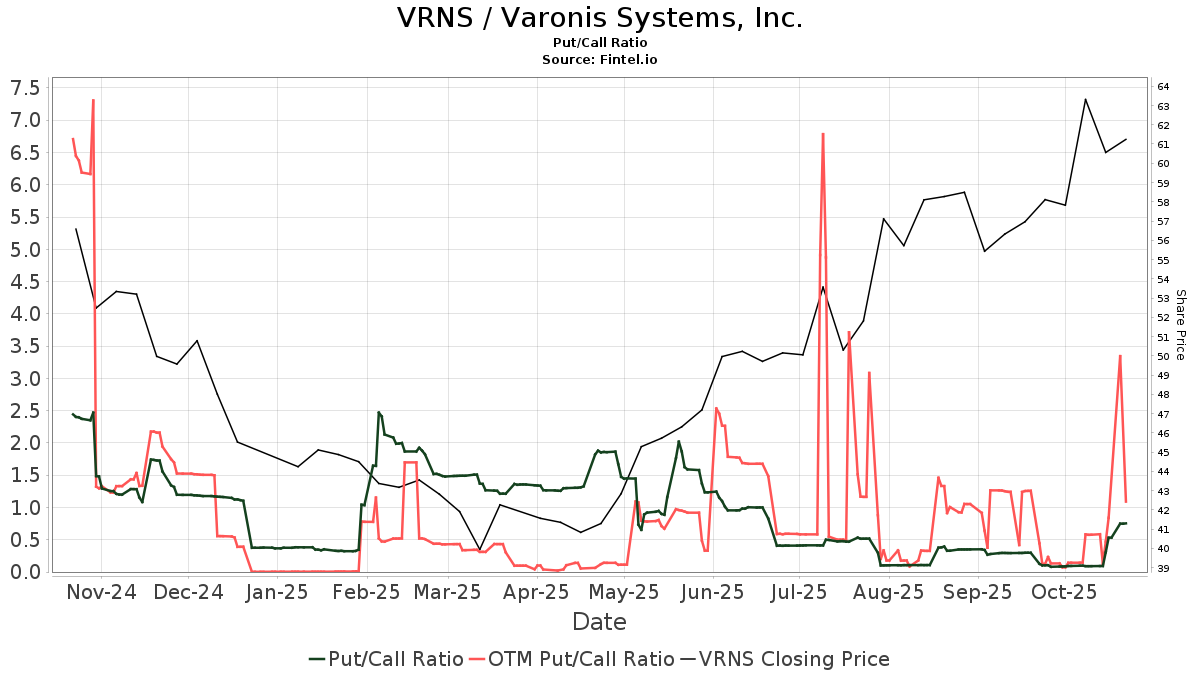

On October 24, 2025, Cantor Fitzgerald maintained an Overweight rating for Varonis Systems (NasdaqGS:VRNS). The average one-year price target is $62.08 per share, indicating a slight downside of 0.33% from its recent closing price of $62.29.

The projected annual revenue for Varonis Systems is $635 million, with a projected non-GAAP EPS of $0.47, marking a revenue increase of 6.71%. Currently, 684 funds report positions in the company, though this number has decreased by 3 in the last quarter. Institutional shares owned have dropped by 2.44% to 144,548K shares.

Key shareholders include Goldman Sachs, which reduced its holdings by 7.42% to 3,803K shares. Conversely, Vanguard increased its stake by 1.24% to 3,438K shares. Other notable changes include Voya Investment Management decreasing its position by 0.41% and First Trust Advisors raising its holdings by 5.23%.

“`