Cantor Fitzgerald Boosts Microsoft Outlook with Overweight Rating

Expected Price Increase of Nearly 19% for Microsoft Shares

According to Fintel, on January 16, 2025, analysts at Cantor Fitzgerald began covering Microsoft (NasdaqGS:MSFT) and issued an Overweight recommendation.

As of December 23, 2024, the consensus one-year price target for Microsoft stands at $510.24 per share, projecting an 18.96% rise from its most recent closing price of $428.91. Predictions range from $429.25 on the low end to $682.50 on the high end.

Key Financial Metrics and Insights

Microsoft is anticipated to generate projected annual revenue of $279.68 billion, reflecting a year-over-year increase of 10.03%. The expected annual non-GAAP earnings per share (EPS) is noted at 13.49.

Current Fund Activity and Market Sentiment

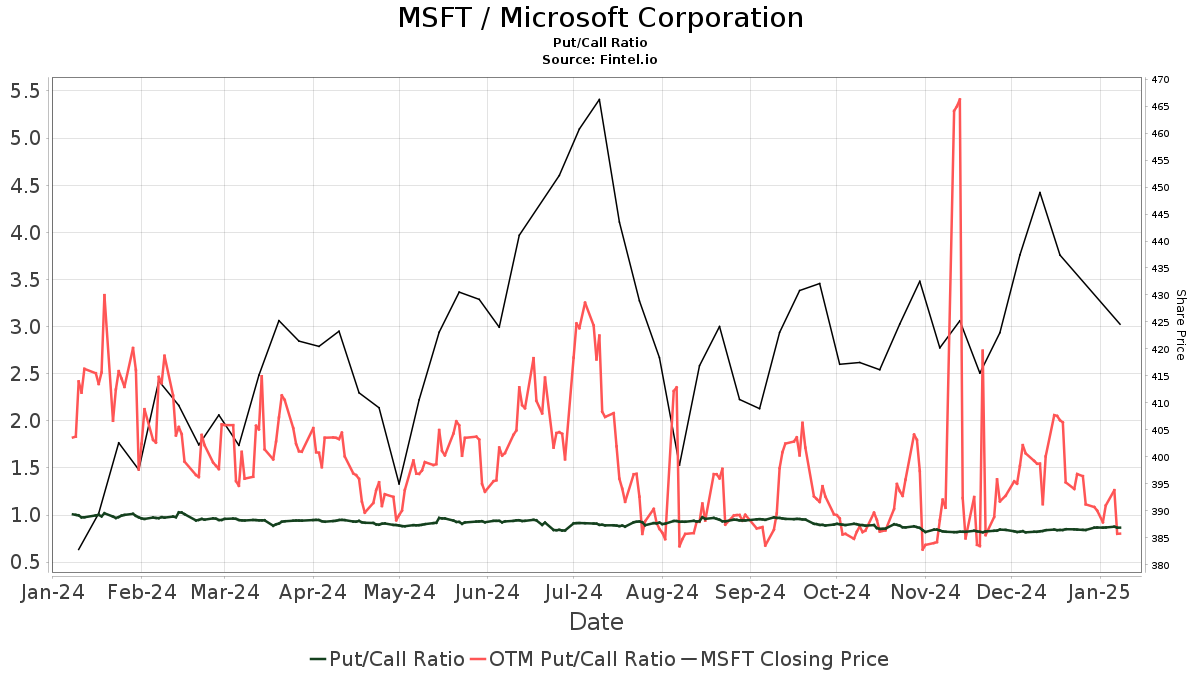

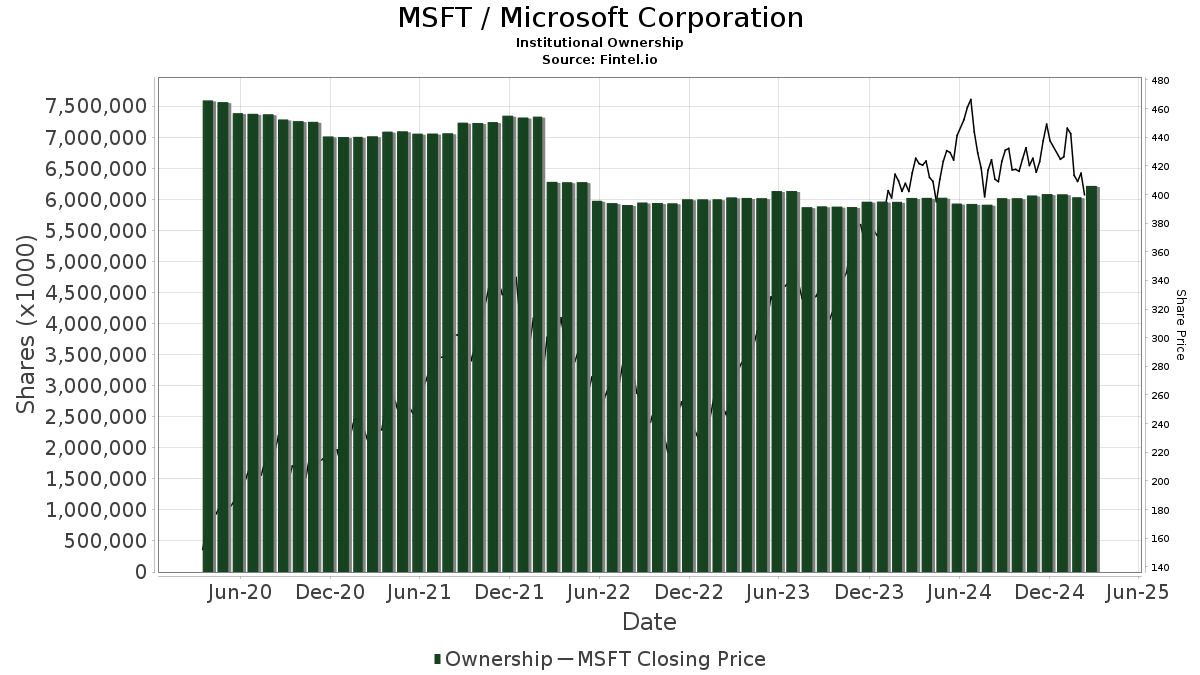

A total of 7,696 institutional funds are currently reporting positions in Microsoft, marking an addition of 89 new holders, or a 1.17% rise, over the past quarter. The average weight of funds in MSFT now stands at 2.82%, up 25.31%. Institutional ownership has also grown, with total shares held increasing by 0.59% in the last three months to 6,050,033K shares.  The current put/call ratio for MSFT is 0.85, suggesting a bullish market sentiment.

The current put/call ratio for MSFT is 0.85, suggesting a bullish market sentiment.

Institutional Shareholder Actions

The Vanguard Total Stock Market Index Fund Investor Shares holds 235,610K shares, equating to 3.17% ownership; this is an increase from their previous holding of 234,788K shares, reflecting a 0.35% rise in shares. However, the allocation to MSFT was reduced by 9.26% in the last quarter.

The Vanguard 500 Index Fund Investor Shares now owns 194,673K shares (2.62% ownership), up from 190,756K shares, which is a 2.01% increase, albeit with a 9.58% cut in portfolio allocation in that period.

Geode Capital Management holds 165,025K shares (2.22% ownership), an increase from 161,760K shares, which translates to a 1.98% gain. They also decreased their position size by 9.44% recently.

JPMorgan Chase now reports 137,853K shares (1.85% ownership), a rise from 133,013K shares, which marks a 3.51% increase as they cut their portfolio allocation by 7.53% in the last quarter.

Lastly, Price T Rowe Associates holds 135,660K shares (1.82% ownership), down from 136,739K shares, showing a decrease of 0.80% alongside an 8.10% reduction in portfolio allocation.

A Brief Overview of Microsoft

(This description is provided by the company.) Microsoft focuses on enabling digital transformations in an era defined by intelligent clouds and edges. The company’s mission is to empower everyone and every organization to achieve more.

Fintel serves as a comprehensive investment research platform for individual investors, traders, financial advisors, and small hedge funds.

The platform offers extensive data on fundamentals, analyst reports, ownership structure, fund sentiment, options sentiment, insider trading activities, and much more. Fintel’s exclusive stock selections utilize advanced, backtested quantitative models aimed at maximizing profits.

Click to Learn More

This article originally appeared on Fintel.

The views expressed in this article are those of the author and do not necessarily reflect the opinions of Nasdaq, Inc.