Understanding the Fund Sentiment

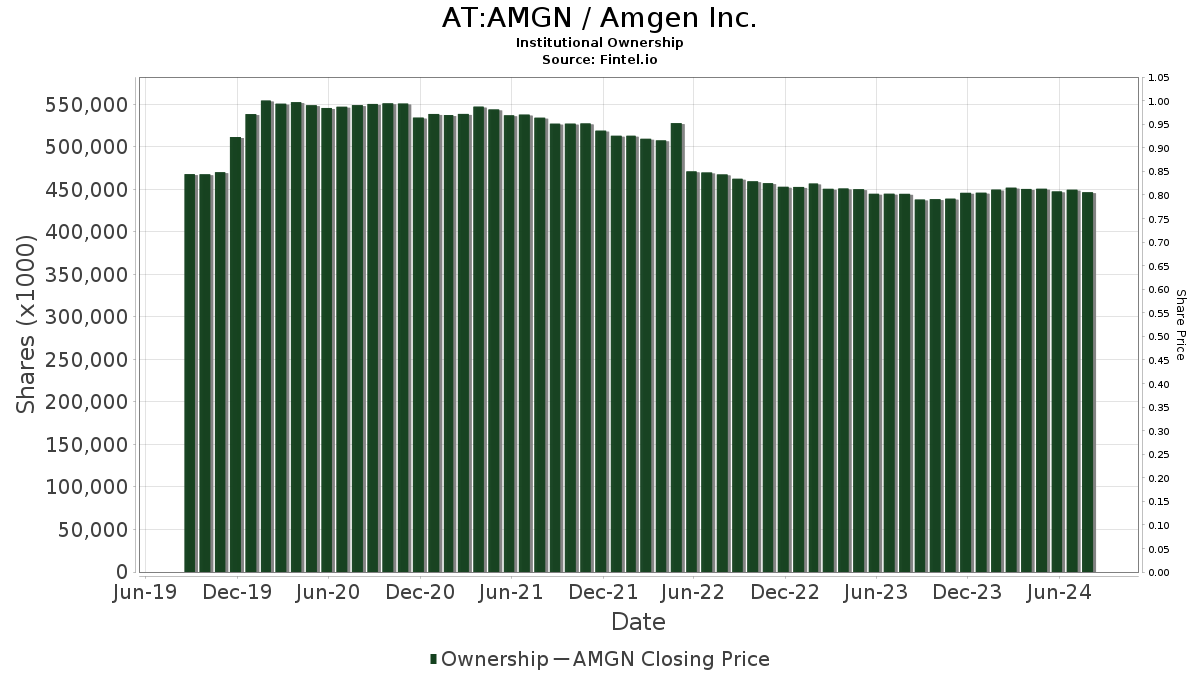

In a move that reverberated through the markets like the pleasant hum of a well-tuned orchestra, Cantor Fitzgerald initiated coverage of Amgen (WBAG:AMGN) with an Overweight recommendation on September 27, 2024. The resonance of this fanciful introduction could be felt by the 4,115 funds and institutions that currently report positions in Amgen, mirroring a 1.66% increase in ownership this past quarter. These entities have dedicated an average portfolio weight of 0.55% to AMGN, signifying an uplifting surge of 5.95%. Furthermore, the total shares held by institutions have blossomed by 5.20% in the last three months, reaching a symphonic crescendo of 458,670K shares.

Insight into Shareholder Activity

As the musings of other shareholders dance across the stage, their movements paint a vivid picture of growing interest and strategic repositioning. VTSMX – Vanguard Total Stock Market Index Fund Investor Shares leads the ensemble with 16,954K shares, boasting a 3.16% ownership stake in the company. In a rhythmic cadence, the firm experienced a harmonic increase of 0.63% in shares held, coupled with a resounding portfolio allocation rise of 7.54% in AMGN over the last quarter.

Primecap Management follows suit, holding 14,447K shares, showcasing a 2.69% ownership share. While the previous filing recorded a slight decrease in shares owned at 1.07%, there was a catchy tune of 5.54% increase in portfolio allocation during the same period. VFINX – Vanguard 500 Index Fund Investor Shares harmonizes with 13,768K shares, representing 2.56% ownership that experienced a delightful increase of 2.07% in shares and 6.23% in portfolio allocation. Geode Capital Management and Invesco Qqq Trust, Series 1 add their own unique rhythms to the chorus, escalating their shares, ownership stakes, and portfolio allocations with each beat of the market pulse.

Unlocking Fintel’s Investment Insights

With Fintel’s melodic investment research platform resonating like a virtuoso performance, individual investors, traders, financial advisors, and small hedge funds are treated to a symphony of data. From fundamentals to analyst reports, ownership statistics to fund sentiment, options flow to insider trading, Fintel’s composition blends the full spectrum of market insights for a harmonious investing experience. And like a seasoned conductor guiding an orchestra, Fintel’s exclusive stock picks, powered by advanced quantitative models, aim to strike the right chords for improved investment performance.

Should you wish to listen more closely to this melodious tale of market dynamics, or savor the sweet sounds of profitable investment strategies, a visit to Fintel’s stage might just be the encore you seek.

Source: This captivating narrative originally unfolded on Fintel’s platform.

The thoughts and expressions shared in this lyrical composition stem from the creativity of the author and do not necessarily mirror those of Nasdaq, Inc.