Lilium N.V. Faces Downgrade as Analysts Predict Significant Price Increase

Recent Outlook Change by Cantor Fitzgerald

Fintel reports that on October 18, 2024, Cantor Fitzgerald downgraded their outlook for Lilium N.V. (LSE:0AB4) from Overweight to Neutral.

Price Forecast Indicates Potential for Growth

As of September 25, 2024, the average one-year price target for Lilium N.V. is 1.99 GBX/share. The projections range from a low of 0.76 GBX to a high of 3.18 GBX. This average price target suggests a substantial increase of 175.43% from its latest reported closing price of 0.72 GBX/share.

Explore our leaderboard of companies with the largest price target upside.

Projected Financial Performance

The anticipated annual revenue for Lilium N.V. is expected to be 0MM, with a change of NaN%. Additionally, the projected annual non-GAAP EPS sits at -0.62.

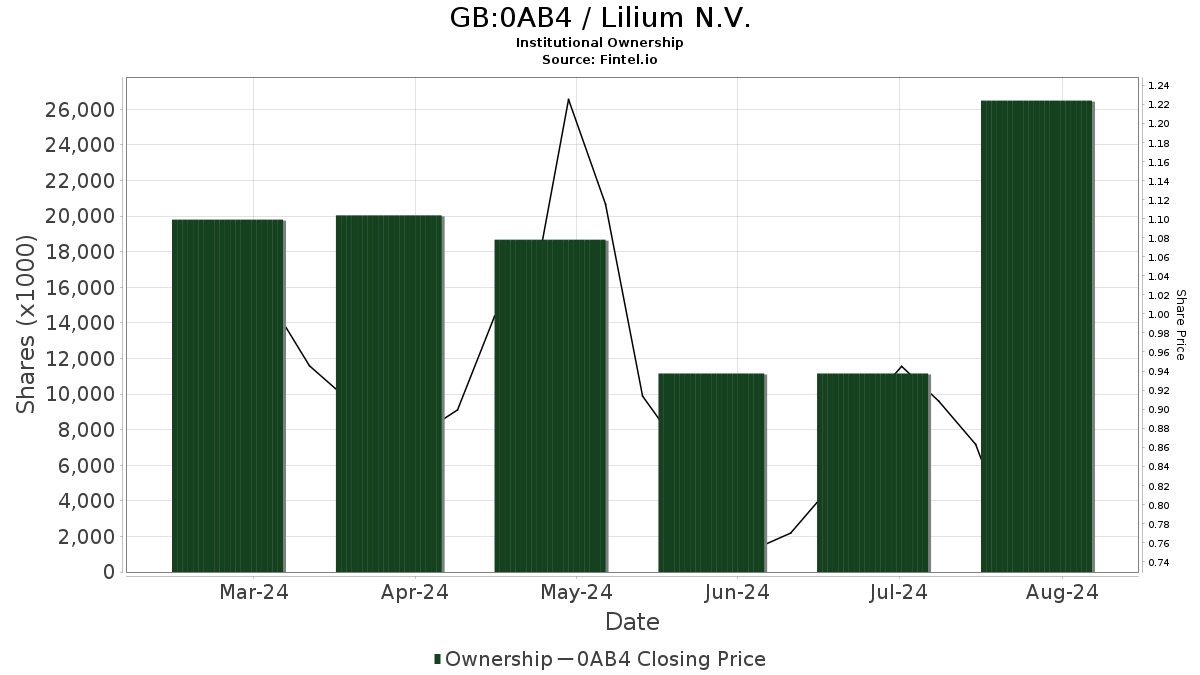

Fund Sentiment Overview

There are currently 65 funds or institutions reporting positions in Lilium N.V., an increase of 7 owners or 12.07% from the last quarter. The average portfolio weight dedicated to 0AB4 is 0.12%, marking a significant rise of 436.22%. Over the last three months, total shares owned by institutions surged by 167.81% to 26,102K shares.

Activity Among Other Shareholders

B. Riley Financial holds 11,028K shares, amounting to 1.81% ownership of the company. This is an increase from their previous report of 0K shares, reflecting a rise of 100.00%.

Allianz Asset Management retains 2,508K shares, representing 0.41% ownership, with no change in the last quarter.

Barclays owns 2,044K shares, or 0.34% of the company. Their previous filing reported 1,606K shares, showing an increase of 21.46%. However, the firm decreased its portfolio allocation in 0AB4 by 7.28% over the last quarter.

AWM Investment holds 2,000K shares, which is 0.33% of the company. Their previous figure was 1,939K shares, indicating a growth of 3.06%. Nevertheless, their portfolio allocation in 0AB4 dropped by 26.79% over the last quarter.

Capstone Investment Advisors possesses 1,759K shares, equating to 0.29% ownership. Previously, they reported 0K shares, resulting in a 100.00% increase.

Fintel is a valuable research platform that serves individual investors, traders, financial advisors, and small hedge funds. Our broad data set includes fundamentals, analyst reports, ownership data, fund sentiment, and more, powered by advanced quantitative models for improved investment outcomes.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.